Despite leading global crypto transactions, the majority of U.S. investors remain largely uninvolved, with just 14% holding digital assets.

Ethereum ETFs experience explosive growth as institutional demand reaches unprecedented highs. With 534 million dollars in daily inflows, these financial products now represent 15% of Ethereum's spot volume, compared to only 3% at their launch less than a year ago.

Exit Gensler, here comes Atkins: the SEC shifts from the brake to the accelerator. "Innovation exemption", multi-crypto ETP, stablecoins… Washington finally discovers that blocking costs more than moving forward.

The leverage effect, driver of soaring increases, becomes a formidable trap when the market turns. Solana (SOL) suffers the consequences, with a brutal drop to $213, its lowest level in two weeks. While the Fed briefly rekindled risk appetite, persistent tensions over inflation and employment quickly reversed the trend.

The Federal Reserve has made its decision, but without certainty. According to Jerome Powell, no interest rate adjustment will be without consequences. While several central banks have started a cycle of rate cuts, the Fed chairman warns of a strategic deadlock. In a context where inflation remains resilient and employment wavers, every decision becomes risky. A strong signal sent to the markets closely watching every word from the Fed as a decisive monetary turning point approaches.

The collapse of FTX has not finished shaking the crypto ecosystem. The FTX Recovery Trust has filed a lawsuit against bitcoin miner Genesis Digital Assets, claiming $1.15 billion. A colossal amount that reminds how much the shadow of FTX continues to hover over the industry.

While the crypto market begins a new phase of pullback, Avalanche surprises. The AVAX token jumped 10% this Tuesday, reaching 33 dollars, at the very moment when major capitalizations showed losses. The crypto thus stands out by an opposite dynamic, built and supported by significant players.

World Liberty Financial appears poised to build on its market entry by pursuing utility-focused growth. The crypto venture, backed by the Trump family, has outlined plans to issue a debit card and retail application, as per recent reports.

When a central bank teams up with Solana and Mastercard to create a stablecoin, it means crypto is no longer reserved for geeks. Kazakhstan is quietly forging its path.

Europe is stepping up its game on stablecoins. Bullish Europe has just listed USDCV, the new dollar-backed stablecoin launched by Société Générale-Forge. MiCA compliant and supervised by BaFin, this token marks a decisive turning point in Europe’s regulatory battle against American giants in the sector.

Investors pulled back from Bitcoin and Ethereum ETFs on Monday, reflecting caution amid market shifts and pending economic data.

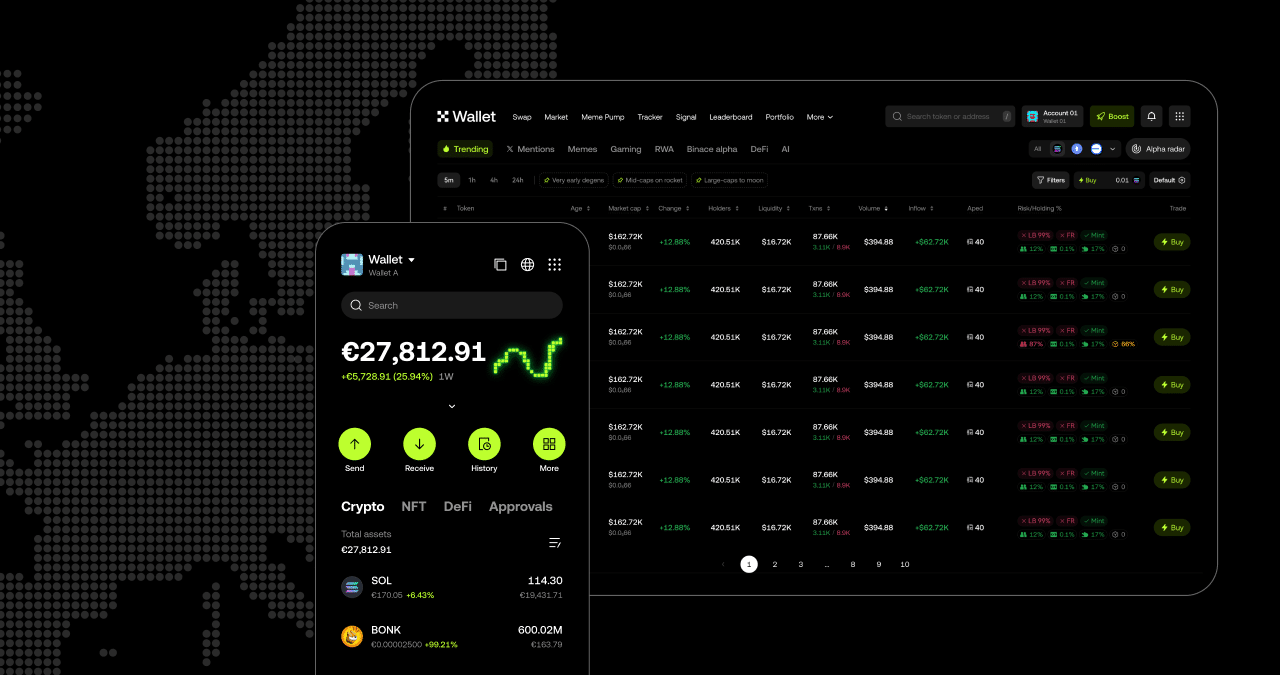

SwissBorg launches a revolutionary cashback system allowing up to 90% savings on crypto trading fees.

Economy: JPMorgan anticipates tensions on the Fed and integrates stablecoins without fearing for its deposits. We tell you more here!

For the first time, Washington speaks with one voice on crypto. After years of partisan deadlocks and ideological battles, Democrats and Republicans are finally breaking their divides to build a common regulatory framework. Twelve Democratic senators have just announced their support for negotiations, accelerating the implementation of a law that could redefine the future of a market worth more than 4 trillion dollars.

Bitcoin consolidates around $112,500 after a bounce on support, but fails to regain clear momentum. Discover the technical outlook for BTC's future evolution.

On Monday, the U.S. and U.K. launched a new joint task force to improve cross-border capital flows into the crypto sector. The special alliance, aimed at strengthening ties between the two nations’ digital asset industries, will include regulators from both countries.

Deutsche Bank predicts Bitcoin could join gold in central bank reserves as markets mature and volatility eases, signalling growing institutional adoption.

In the global battle to dominate artificial intelligence, computing power has become the new currency. Nvidia is set to inject up to 100 billion dollars into OpenAI to build one of the most ambitious AI infrastructures ever conceived. This partnership marks a turning point, as the time for laboratory promises is over, and the era of massive AI industrialization begins. Such an initiative could reshuffle the cards of the sector and redefine technological power relations on a global scale.

Nearly three years after the collapse of FTX, the shadow of the scandal still lingers. Ryan Salame, former co-leader of the platform, is serving a heavy sentence, but his plea deal remains at the center of a legal battle involving his wife, Michelle Bond. The justice system is still trying to unravel the ramifications of an explosive case.

While retail investors tremble at the slightest dip, corporate whales are devouring millions in bitcoin. Coincidence? Or a new strategy from the "private central bankers" of crypto?

September once again catches up with the crypto market. After a promising start, the trend reversed with a brutality that hits the main capitalizations. Bitcoin, Ethereum, and Dogecoin show a sharp decline, exposing a marked exhaustion of the bullish momentum. As every year at the same time, the specter of a "Red September" reappears, fueled by weakened technical signals and a sharply declining market sentiment. Once again, the scenario of a red month seems to be drawing with insistence.

Metaplanet has expanded its Bitcoin holdings to 25,555 BTC with a $632 million purchase, climbing into the top five public company treasuries.

At Saylor's, the vaults overflow: 639,835 bitcoins in reserve! While Wall Street grimaces, Strategy plays the global treasurer of an increasingly coveted digital gold.

Over the years, Bitcoin has evolved from a peer-to-peer payment system to a sought-after global asset. Regional governments are now looking to the OG crypto as an inflation hedge, and corporate Bitcoin treasuries have emerged as a rising trend. Yet for Tim Draper, venture capitalist and founder of Draper Associates, Bitcoin’s role goes far beyond a store of value. He maintains that the first-born coin will become a cornerstone in the future of finance and even national defense.

The crypto market has just endured one of its harshest shocks since the start of the year. In less than 24 hours, more than 407,000 positions were liquidated, wiping out over 1.5 billion dollars of bullish bets from order books. This quick correction, triggered by the domino effect of margin calls, shook the largest capitalizations while revealing the vulnerability of a market still dominated by leverage and massive speculative movements.