ADA, Cardano's native cryptocurrency, is currently showing a bullish trend despite the bear market and is trading around $0.30. However, some signals indicate that a potential decline in the asset's valuation cannot be ruled out.

News

On Tuesday June 20, EDX Markets, a new crypto exchange, announced the launch of its trading activities. The launch did not go unnoticed in the ecosystem, as the platform enjoyed the support of a consortium of popular institutions in the financial universe. These include Wall Street giants Fidelity Investments, Charles Schwab and Citadel Securities.

BlackRock recently filed a Bitcoin ETF application with the SEC. According to several analysts, the process could be beneficial for the price of Bitcoin (BTC) by attracting more institutional investors. Recent trends point to an increase in institutional investors' confidence in the crypto market.

After plummeting to $25,000, the Bitcoin price is skyrocketing. Many see this dynamic as a positive development. However, Peter Schiff disagrees. The investor criticizes the skyrocketing price of the flagship cryptocurrency. He believes the trend will only last for a short time.

Many believe that the 2024 Bitcoin Halving will be decisive for the cryptocurrency. But instead of waiting a few months to cheer up the crypto community, BTC took many by surprise today. It traded at $138,000 early in the morning on Binance.US.

Michael Saylor made statements on Bloomberg that stand in stark contrast to what we have been hearing from "Austrian" economists.

The main event of this weekend was the Saint Petersburg International Economic Forum. Sharing the stage with his Algerian counterpart, the Russian president predicted the end of the dollar.

Like any major price movement of a cryptocurrency, the rebound of Bitcoin (BTC) observed over the past week has attracted the attention of analysts. While some experts were quick to predict a bullish trend for the queen of cryptos after this rebound, others believe that it will take even more for a true bull market to unfold. This is the case for trader Tone Vays, who scrutinized the movements of the flagship cryptocurrency and predicted different scenarios leading to a bullish trend for Bitcoin (BTC).

Elon Musk, the CEO of Tesla and SpaceX, has denied allegations that he holds a Dogecoin portfolio linked to insider trading. The ongoing class-action lawsuit accuses Musk of being involved in a racketeering scheme to support Dogecoin. The plaintiffs are seeking $260 billion in damages. According to court documents, two wallets associated with Musk sold 1.4 billion Dogecoins, worth over $124 million, over a two-day period in April.

The recent publication of Hinman's documents, a former SEC executive, has surprised the crypto community. They were supposed to provide the elements to settle the debate about the security or non-security nature of cryptocurrencies. Instead, the documents in question have only created more confusion. The situation was such that Ripple CEO Brad Garlinghouse called for investigations into William Hinman.

Binance étant au cœur des polémiques liées aux attaques du régulateur Américain, le cours du Binance coin (BNB) en a littéralement payé les frais.

They're in high school, but are already as rich as Croesus. How did they achieve this feat? By using unorthodox techniques such as phishing-based NFT scams. Currently, several million dollars have found their way into their hands. You'll never guess how they're squandering their ill-gotten gains.

The crypto market saw a significant rise on Friday, mainly thanks to a positive announcement from BlackRock. Bitcoin (BTC), one of the big winners following this news, recorded a 6.7% rise, which could signal a resumption of the bull-run.

The European Union is gearing up to write a decisive new chapter. The rules governing the Markets in Crypto-Assets (MiCA) are fast approaching, promising a series of far-reaching changes for companies in the cryptosphere.

Ripple CEO Brad Garlinghouse recently shared a video on Twitter to announce that his company's long-running legal battle with the Securities and Exchange Commission (SEC) was finally coming to an end. However, rather than feeling sorry for the failure, Garlinghouse emphasized that the case only marks the beginning of a wider struggle for the cryptocurrency industry and the need for regulatory clarity.

Over the past few months, many analysts have predicted that Ripple would win its case against the SEC. However, it now seems that this prediction is about to change. Could the recent disappointing revelations about the Hinman documents be turning the tide?

BlackRock is particularly interested in cryptocurrencies, as well as ETFs. A few months ago, the company launched an ETF in Europe. This time, they have set their sights on a Bitcoin ETF. There is no guarantee that this process will be successful, but it could have significant effects on the flagship cryptocurrency market.

The SEC's legal action against Binance continues to make headlines in the crypto world. Binance executives have vowed to fight and defend their platform. But does the SEC, the one who initiated the battle, really have the means to win this showdown? Carol Alexander has her doubts. Here's why.

We are pleased to present to you today a project that is both unique and ambitious: BlueWine. Behind this intriguing name lies the very first streaming platform dedicated to the world of wines and spirits. With a wide range of documentaries, films, series, and reports from all corners of the…

The renowned analyst Bluntz is known for his bearish predictions in the crypto market. His projections have hit the mark in the past, like when in 2018, the analyst successfully predicted a significant drop in Bitcoin's valuation. In this post, we'll share his latest analysis regarding the queen of cryptos.

It's clear that Ripple won't wait for Judge Torres' conclusion to establish its supremacy as a financial services provider for businesses. Therefore, Brad Garlinghouse's company has decided to expand its operations in Europe if MiCA becomes law. Zoom!

In an already well-established geopolitical context, BRICS is gradually carving out a significant disruptive role. This coalition of emerging nations is intensifying its economic power with such force that the pressure keeps mounting. This trend is redefining global power dynamics, and some states, like France, seem to have no intention of remaining mere observers.

US Treasury Secretary Janet Yellen warned Congress on Monday to expect a gradual decrease in the share of the dollar in global reserves. US debt.

The Hinman documents, previously held by a former SEC executive, are at the core of the legal battle between the SEC and Ripple. According to Ripple, their disclosure is crucial to the outcome of the case. The disclosure has finally happened but falls short of Ripple's expectations, leaving its executives disappointed.

A solo miner defies the odds and hits the jackpot! With a one in 5,500 chance, this independent miner struck gold by solving a Bitcoin block worth 6 BTC, approximately $160,000. What makes this remarkable feat even more impressive is that it was achieved using mining hardware that is six years old.

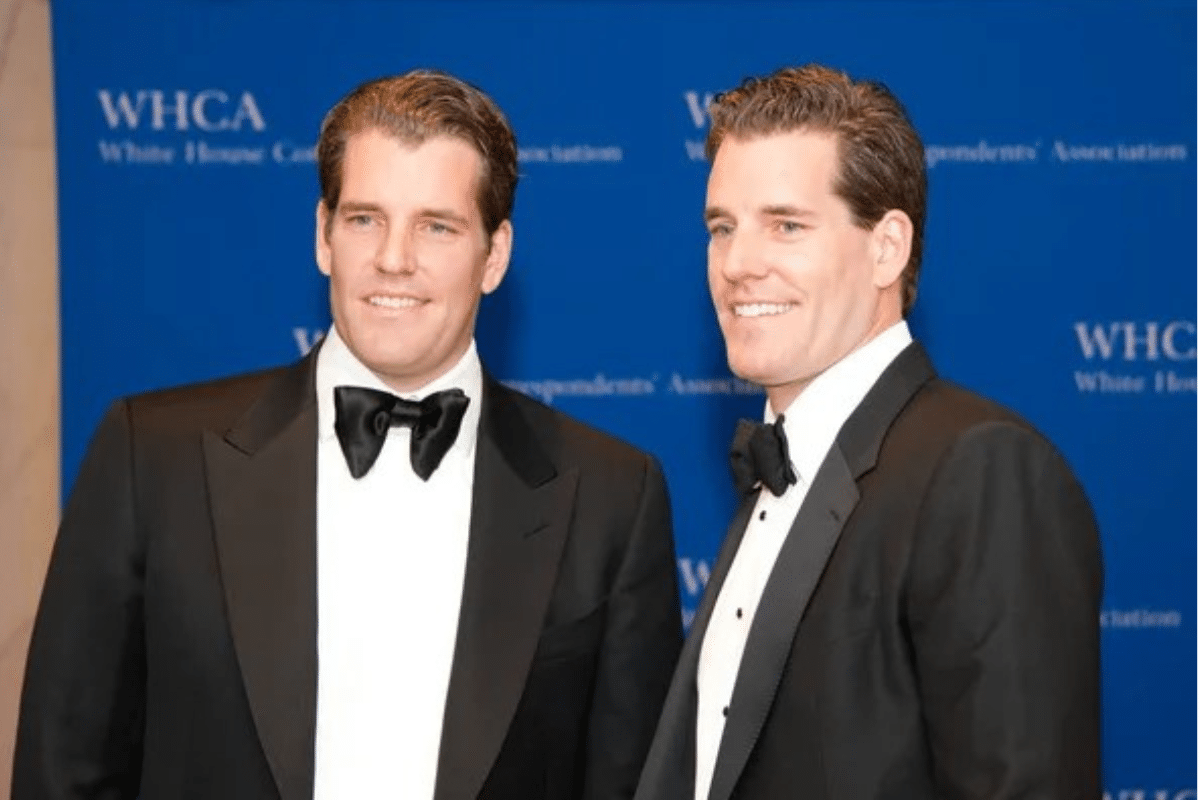

Despite the recent collapse in its price, many fervent bitcoin supporters still believe in its potential. The Winklevoss brothers, Tyler and Cameron, are among those bitcoiners who see the asset reaching new heights.

In the SEC VS Binance case, a US federal judge has rejected the request from the US regulator. Quick breakdown: Binance US assets will not be frozen. However, the judge demands further negotiations between the SEC and Binance lawyers. The goal is to define boundaries and resolve security issues.

Crypto billionaire Cameron Winklevoss has warned that the ongoing crypto war orchestrated by Senator Elizabeth Warren and SEC Chairman Gary Gensler could harm the Democratic Party. He was followed by his twin brother, Tyler Winklevoss, who is more specific and predicts a Democratic defeat in the 2024 presidential elections if this war continues.

The SEC appears determined to take drastic measures in the crypto sector. After officially targeting two major crypto exchanges, it is now intervening in cryptocurrencies. The classification of certain cryptos as unregistered securities has triggered a price drop for many altcoins. Among them, Algorand and Flow reached their lowest levels over the weekend.

A week ago, the SEC launched its war against two crypto giants and didn't forget to shake up around fifty assets classified as “unregistered securities” along the way. Many did not expect such a turn of events. The prices of certain cryptocurrencies plummeted. Even the flagship crypto's price was affected by this attack from the US regulator. However, according to Glassnode, long-term BTC hodlers are unfazed by this storm.