Against a backdrop of techno, Cardano injects social elements: a Constitution engraved in the blockchain, global votes, and a dream of equality signed by Hoskinson. The gentle revolution is underway... decentralized.

News

Hayden Adams, founder of Uniswap, believes that Solana is currently the best blockchain to scale decentralized finance (DeFi) at the layer 1 level. This stance reignites the debate on the limitations of Ethereum's modular model.

On April 20, 2025, Dogecoin holders celebrate the now traditional Doge Day, a festive day born in 2021 alongside the global cannabis day. While the DOGE community remains as enthusiastic as ever, a major event could soon redefine the landscape of this iconic crypto: the possible approval of a Dogecoin ETF by the U.S. SEC.

Peter Brandt's explosive prediction about Ethereum (ETH) has electrified the crypto community. This veteran trader, whose career spans five decades, anticipates a collapse in the price to around $800, a level unseen since 2022. While ETH struggles to stabilize above $1,600, this warning reignites debates about the uncertain future of the second-largest cryptocurrency. Between relentless technical analysis and the unwavering optimism of certain industry figures, the market is divided. But who is really right?

Bitcoin and Ethereum users can finally breathe easy: transaction costs on the two main blockchains have dropped by more than 90% compared to the previous year. This major change reflects a calming of network activity, but also a notable improvement in operational efficiency.

In the crypto world, the "unit bias" leads many investors to favor cheap altcoins over Bitcoin. According to Samson Mow, this mistaken perception distorts investment decisions and fuels an illusion of value. BTC dominance could thus explode far beyond forecasts!

Despite signs of sustained activity, Shiba Inu (SHIB) is sinking into a downward spiral of underperformance. Contrary to the rebound seen in other altcoins, the token shows a historically low profitability rate, revealing a deep imbalance in its market structure. The majority of wallets remain in the red, even as trading volumes explode. This stark contrast between apparent excitement and massive losses raises a simple question: what is really happening behind the numbers?

Bitcoin's dominance in the crypto market is approaching a historical resistance level that has previously triggered major reversals. According to a technical analysis published on TradingView, BTC's market share could collapse to 40% in the coming months, potentially paving the way for a new altcoin season.

In a world where information often blends with misinformation, Telegram, the encrypted messaging app, found itself at the center of an unprecedented controversy. While France claims to have forced the platform to comply with European regulations following the arrest of its founder, Pavel Durov turns the accusation around: according to him, it was the French authorities who delayed implementing the procedures stipulated by the EU. A rhetorical duel that reveals deeper tensions over the control of tech giants.

While the United States tightens its tariff arsenal, the rest of the world is organizing itself. Thus, the BRICS bloc attracts economies seeking strategic independence. Breaking away from the established monetary order, this alliance is reshaping trade routes and weakening the dollar's dominance. A silent but structural shift is underway.

When Robert Kiyosaki speaks, the markets listen. The author of "Rich Dad, Poor Dad," an iconic figure in alternative finance, predicts a bitcoin worth 1 million dollars by 2035. In a global climate weakened by debt, inflation, and mistrust towards institutions, his statement fuels debates about the safe-haven value of cryptocurrencies. Prophetic vision or alarmism? The future of bitcoin may already be written between the lines of this announcement.

While the crypto market oscillates without a clear direction, some internal dynamics are stirring tensions. This month, the Pi Network project is preparing to inject a massive amount of tokens into the market. This operation is being closely watched, as its scale could worsen the selling pressure on the price of Pi, an already fragile asset. The chosen timeline, combined with alarming technical signals, outlines a scenario to be monitored very closely.

The $TRUMP token, once a rising star, plummets 90% with the unlocking of 40 million tokens, revealing the risks of a controversial presidential crypto strategy.

The Bank for International Settlements (BIS) has just issued an unprecedented warning: cryptocurrencies and decentralized finance (DeFi) may have crossed a critical threshold, threatening global financial stability. Behind this observation lies a paradox. While the crypto ecosystem prides itself on democratizing finance, according to the BIS, it could amplify inequalities and create unexpected systemic risks. Between massive adoption, shaky regulation, and contagion effects, here is an analysis of a warning that is shaking the markets.

While markets struggle to regain their momentum, a silent accumulation of bitcoin by the largest holders, the famous "whales," is reshuffling the cards. By absorbing much more than the newly issued supply, these players are changing the market balance. This discreet but massive movement reignites speculation: is it the beginning of a new bullish rally, or just a strategic repositioning out of sight?

As uncertainty grips global markets, a strong signal emerges from the Bitcoin network: more than 170,000 BTC, nearly 14 billion dollars, have left dormant wallets. Such a rare and massive movement reactivates the specter of high volatility. In response to this on-chain shock, investor strategies are fragmenting between distrust and accumulation.

The shadow of Donald Trump once again looms over American financial stability. His recent threat to fire Jerome Powell, chairman of the Federal Reserve (Fed), is not just another provocation. It is a political gamble that could crack the very foundations of monetary independence. A scenario where the impulsiveness of one man overturns the global economic chessboard. But behind the loud declarations lies a very real systemic risk, candidly analyzed by influential voices like Anthony Pompliano. Explanations.

Stock tokenization, still a modest segment, could experience spectacular expansion in the coming years. According to several industry leaders, this market is expected to surpass $1 trillion in market capitalization in the medium term, driven by growing institutional interest.

While Bitcoin struts on the stock market like a peacock in rut, Ethereum broods in silence. Zero inflows, zero outflows: investors have clearly put Ether on a dry diet.

In 2025, record US debt issuance is worrying the markets. Is crypto becoming the last refuge? Analysis.

Ethereum could soon find itself in a technical deadlock as the growth of layer 2 solutions threatens to saturate its processing capacity, despite planned improvements.

Like a seismograph recording the first tremors, CryptoQuant sounds the alarm: Bitcoin is preparing for a major shakeup. According to the platform, 170,000 BTC, held for three to six months, have started to move on the chain. A historic signal, often a precursor to market storms. Between fleeting panic and anchoring strategies, the market is fracturing. An analysis of an alert that could redefine the coming weeks.

Despite a recent rebound above the psychological threshold of $0.60, Cardano (ADA) remains under bearish pressure. The flagship crypto of the Cardano ecosystem temporarily reclaimed this critical zone, but market data and technical analysis suggest that sellers maintain the short-term advantage.

The escalation of trade tensions between the United States and China is once again disrupting global financial markets. Cryptocurrencies and tech stocks are bearing the brunt of the impact from the new tariff measures announced by the Trump administration, which has imposed duties reaching up to 245% on certain Chinese imports.

In a recent explosive statement, Donald Trump did not mince his words regarding Jerome Powell. The American president stated that the "resignation of the Fed chief couldn't come soon enough" and that he would not hesitate to fire him if he wanted to.

This Friday, while stock markets close for "Good Friday," the crypto market remains tense. Over $2.2 billion worth of options on Bitcoin and Ethereum are expiring: a massive volume that captures traders' attention. This technical expiration, although expected, occurs in a climate of significant uncertainty, between bullish signals, extreme pain levels, and pressures related to U.S. monetary policy. While the options expire, the risks remain fully intact.

In the bustling city of Dubai, a company named Nexum has been quietly working behind the scenes for years to build a solution that could revolutionize global financial management. With blockchain technology at the core of its approach, Nexum's mission is to bridge the gap between traditional financial systems and the decentralized future. Its goal: to offer solutions that are both innovative and tailored to the real needs of industries such as maritime transport, trade finance, and commodities. As global economies face inefficiencies and regulatory challenges, Nexum's blockchain-powered solutions provide a pathway to a future where financial transactions are faster, more secure, and more inclusive.

Bitcoin is playing the star, but altcoins are sharpening their promises. Between wild memecoins, restrained regulators, and creative projects, 2025 could well offer a dance of outsiders.

Gold just hit a historic peak at $3,357 an ounce in April, sparking a burning question: will Bitcoin follow suit? As investors look for safe havens amid economic turbulence, some experts are scrutinizing the links between these two assets. But is this correlation systematic, or does it hide more complex realities? A dive into the data and underlying mechanisms.

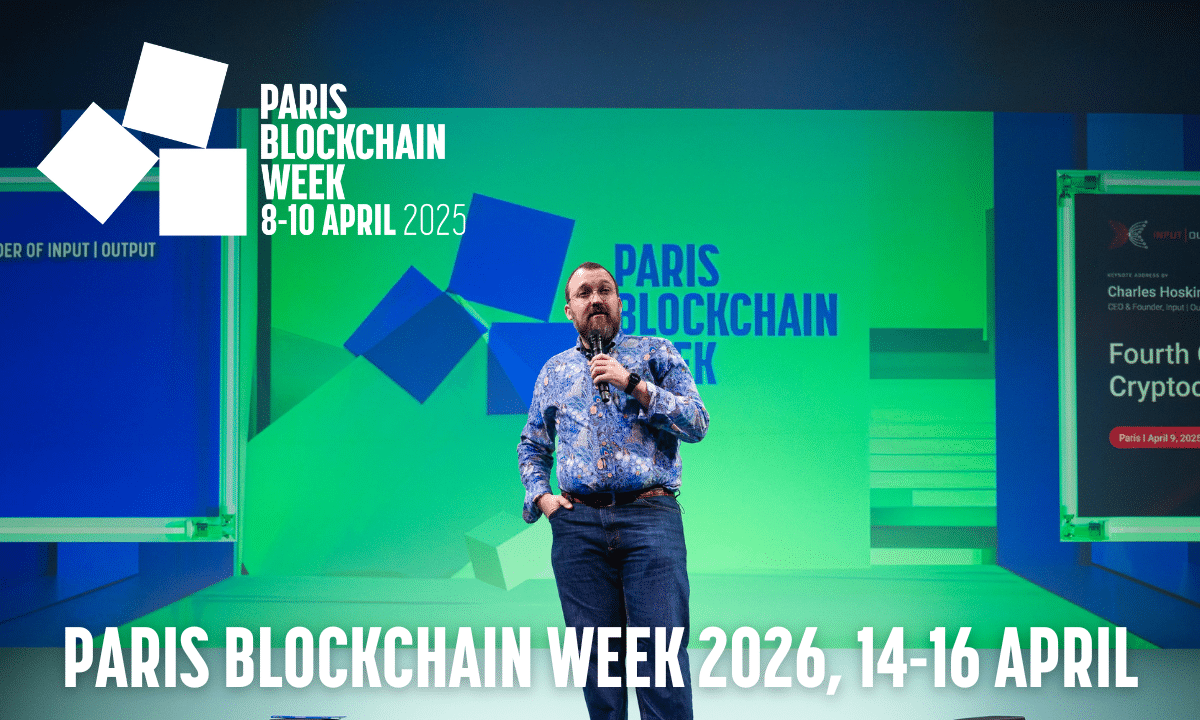

Paris Blockchain Week, Europe's premier blockchain and Web3 event, wrapped up its sixth edition at the iconic Carrousel du Louvre, setting a new standard for industry gatherings. The event was a resounding success, drawing over 9,600 attendees from 95 countries, including an impressive 67% C-suite executives, demonstrating the strategic significance of blockchain across global business leadership.