Pump.fun rejoices, Solana celebrates: PumpSwap dethrones its rivals. Crypto record at $878M, but already, criticisms and rug pulls darken the memecoins sky.

Archive September 2025

While most nations are still hesitant to take the step, Kazakhstan is accelerating. Its president, Kassym-Jomart Tokayev, has just announced the creation of a national cryptocurrency reserve, accompanied by a clear call to build a true ecosystem of digital assets. A bold decision for this Central Asian country, already a major player in global mining.

The crypto ecosystem has just suffered one of the most sophisticated attacks in its history. A "crypto-clipper" injected via compromised NPM modules quietly diverts wallet addresses during transactions. How did this breach escape security radars?

NFT sales dropped below $100 million in the first week of September, ending a two-month streak of strong summer performance.

A hijacked NPM account was at the center of a major supply-chain breach, putting the JavaScript ecosystem and crypto users at risk.

Malicious actors are at it again, this time targeting the account of a well-known software developer's node package manager (NPM). Investigations revealed that the hackers added malware to popular JavaScript libraries, primarily attacking crypto wallets. However, after launching what industry sleuths describe as the largest supply chain attack in crypto history, the hackers managed to steal only $50 worth of crypto assets.

OpenSea, the leading NFT marketplace, has launched a $1 million reserve to acquire and preserve culturally important digital art. The reserve began with the purchase of CryptoPunk #5273, marking a new chapter for the platform in showcasing NFTs as historical and artistic artifacts.

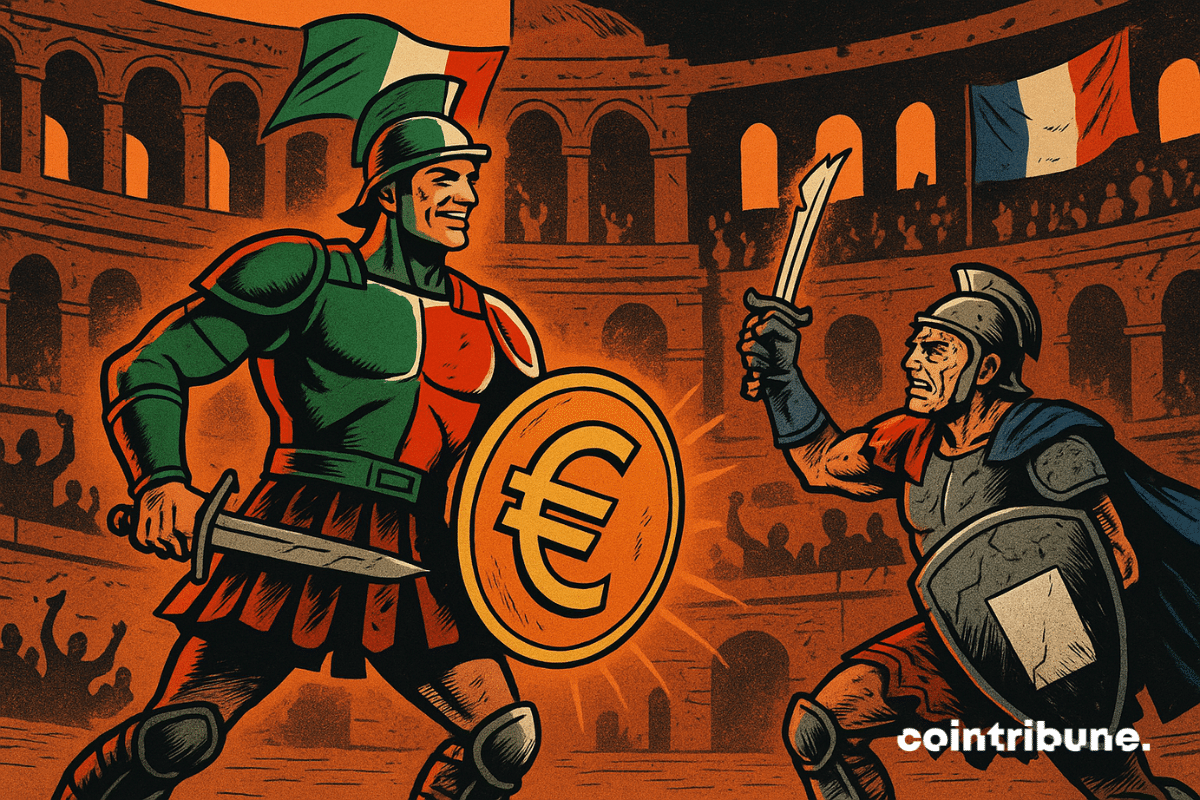

The hierarchy of European sovereign debts has just shifted. On Tuesday, September 9, France borrows at a higher rate than Italy on ten-year bonds. Less than 24 hours after the fall of the Bayrou government, the markets have decided: the French signature is no longer a refuge. This reversal, unprecedented in over a decade, marks a loss of confidence affecting the State's budgetary credibility.

Bitcoin flirted with $113,000, traders were enthusiastic, the Fed was complacent, and Saylor was euphoric. But without spot buying, beware of a backlash: the intoxication could quickly turn to vertigo.

As economic tensions intensify between major powers, a dissenting voice challenges the dominant narrative in Washington. According to Boris Kopeikin, chief economist at the Stolypin Institute, the US trade deficit with China is not the result of a BRICS strategy, but rather a structural weakening of the American economy. This interpretation reignites the debate on the root causes of American imbalances in a world undergoing major reconfiguration.