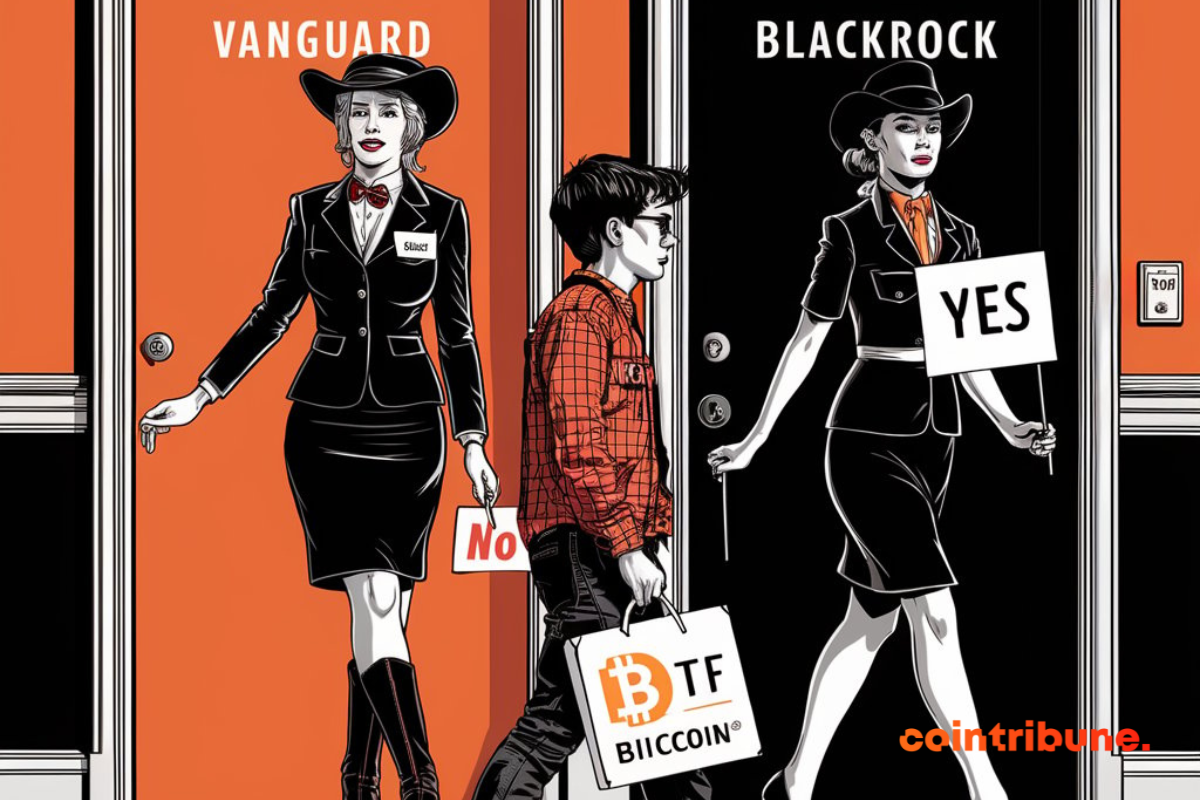

Vanguard on the crypto touch: "We do not copy BlackRock, nor their Bitcoin ETFs." There, it's said!

Archive August 2024

The year 2024 will have been marked by notable fluctuations in the crypto market, but this has not dampened the enthusiasm of institutional investors for Bitcoin ETFs. Despite a 14.5% decrease in the asset's value during the second quarter, major financial players have shown remarkable resilience.

Discover the story and the future of the memecoin $HUAHUA with Zdeadex, its creator, in this exclusive and exciting interview.

In a market as unpredictable as that of cryptocurrencies, every fluctuation in economic indicators can trigger shocks of formidable magnitude. While some see Bitcoin as a safe haven against economic uncertainty, the reality of August 2024 once again demonstrates that this asset class remains profoundly sensitive to the headwinds of the global economy. In recent hours, the crypto market has been hit hard by a series of economic and institutional developments that have precipitated a brutal drop in prices.

The return of the ISF frightens wealthy savers: Discover why Luxembourg is becoming their preferred tax refuge.

As digital markets continue to mature, a complex dynamic is beginning to emerge and disrupt traditional trading models: liquidity fragmentation. This phenomenon, far from anecdotal, could well redefine the rules of the game on major crypto exchange platforms, accentuating price disparities and increasing volatility.

Arrest of Holograph hacking suspects: a major breakthrough in the fight against cybercrime and crypto security.

The Solana crypto, often hailed as the "Ethereum killer", is now at the center of controversy. Accused of hosting a disguised Ponzi scheme structure, the network faces allegations of manipulation, raising questions about its decentralization and the fairness of its ecosystem. While voting transactions represent a overwhelming share of activity, critics point to a system that seems to favor the most powerful validators, to the detriment of newcomers. But what is the reality? Let's decrypt the issues.

The crypto market, known for its legendary volatility, has struck again. In a matter of hours, Bitcoin and Ethereum, the two largest cryptocurrencies in the market, saw their prices drop sharply, leading to a wave of liquidations that exceeded $175 million.

Faced with the increasing restrictions imposed by the West, Russia and China are now exploring alternative ways to maintain their exchanges. As Chinese banks, once open to transactions in yuan, begin to close their doors to Russian payments for fear of reprisals, new methods are emerging.