Nakamoto Holdings becomes the symbol of a fatigue in the Bitcoin treasuries model. Discover all the details here!

Archive 2025

What if your software soon handled your payments without you? Google takes a step closer to this reality by launching an unprecedented protocol: its intelligent agents can now exchange money between themselves via bank cards and dollar-backed stablecoins. This project, supported by Coinbase and other companies, paves the way for an automated economy where AIs no longer just assist you... but act on your behalf.

Banks are screaming disaster, Coinbase responds with numbers: stablecoins do not swallow deposits, but happily crunch the $187 billion in banking fees.

The most underestimated risk of bitcoin may no longer be its volatility, but its gradual disappearance from the market. A new report from Fidelity Digital Assets warns of an increasingly marked dynamic: a growing share of the BTC stock is accumulating in inactive or institutional wallets, permanently escaping liquidity. By 2032, this concentration could reach a historic threshold, redefining the available supply and market balances.

Bitcoin and Ethereum are no longer the only ones capturing the attention of large institutional investors. Solana is now positioning itself as a new leading player among this elite. According to the latest data published by the Strategic Solana Reserve, corporate treasuries now hold more than 17 million SOL tokens, a value exceeding 4 billion dollars.

Less than a year after a record $4.3 billion settlement with the US Department of Justice, Binance seeks to turn the page. The platform, a pillar of the global crypto ecosystem, is negotiating the lifting of the monitoring imposed by the authorities under the agreement. This move raises questions about the evolution of the balance of power between regulators and major players in the sector.

Washington dreams of a digital safe: one million bitcoins in the national reserve. But between orange ties, Republican promises, and empty coffers, the crypto political saga unfolds with suspense.

With the U.S. Federal Reserve set to deliberate on a possible rate cut, appetite for risk assets is building. In fact, investors have poured over $600 million into crypto-focused exchange-traded funds (ETFs) in the past seven days. Capital rotation in Ethereum ETFs has also resumed, following periods of exits.

Pump.fun handled over 1 billion in daily trading volume, setting a new milestone for the platform. Meanwhile, the wider memecoin market experienced a broad rally, with trading activity and market capitalisation surging.

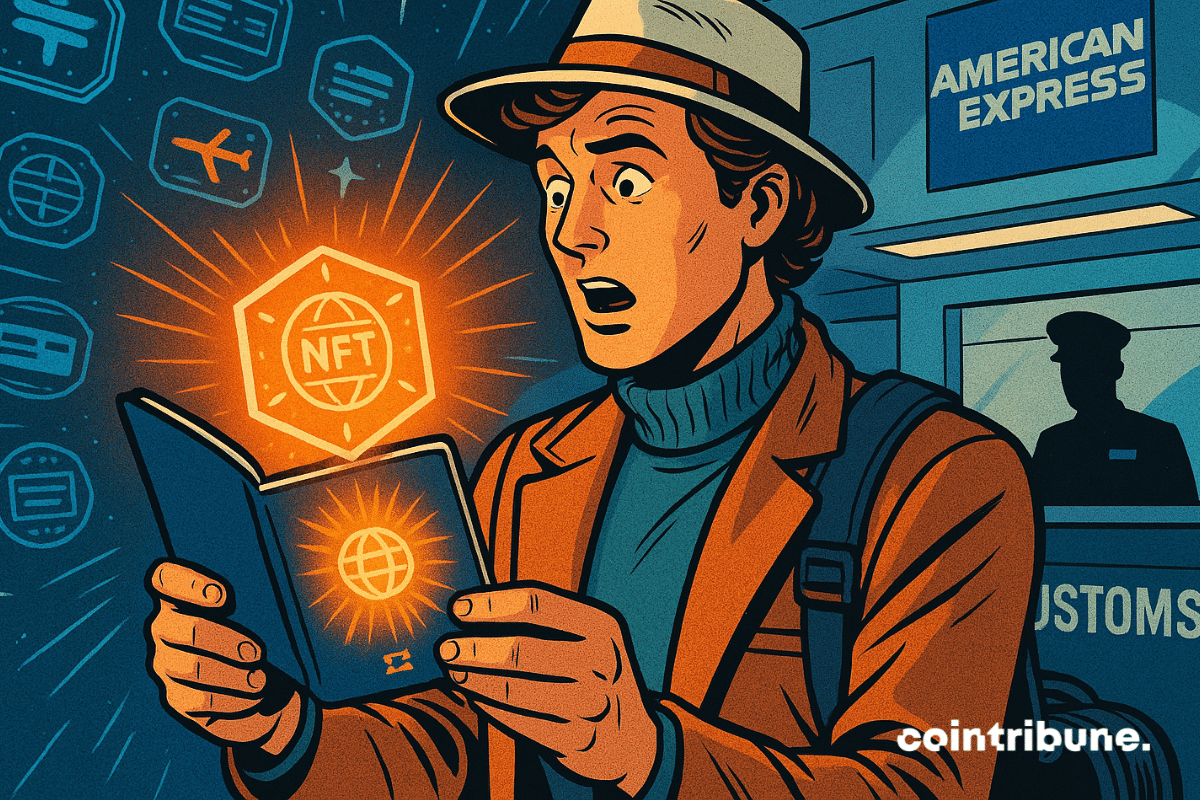

American Express is letting travellers collect NFT passport stamps to capture trips digitally and personalise memories securely.