Bitcoin sulks, altcoins stir: 55% dominance and tokens lying in wait... But who will really take the pot by December?

Archive September 2025

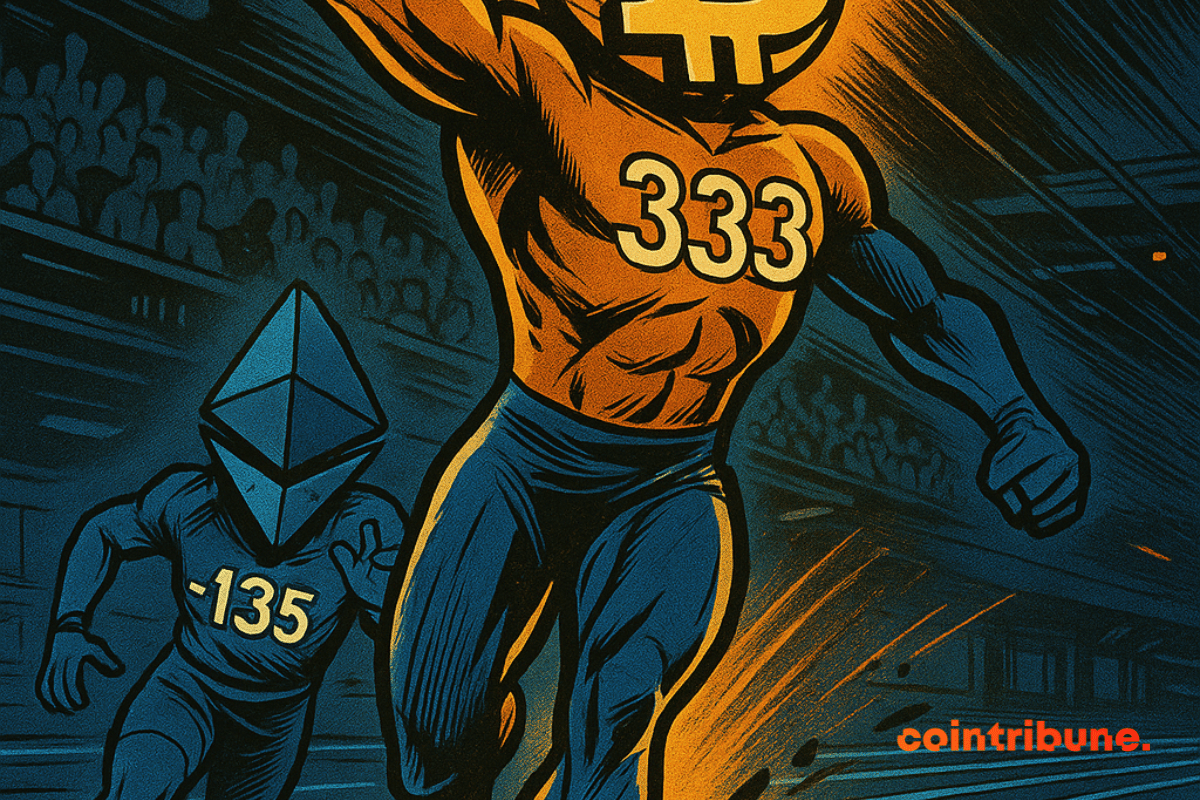

September starts with a marked contrast on crypto ETFs: Bitcoin captures $333M in inflows, while Ether suffers $135M in outflows. This movement confirms bitcoin's place as a safe haven, but the decline in overall volume ($3.93B) and net assets ($143.21B) highlights persistent caution in the crypto market. Crypto ETF flows reveal a clear divide between triumphant Bitcoin and struggling Ether. This crypto dynamic reflects a strategic repositioning by investors, strengthening confidence in Bitcoin despite the caution.

While bitcoin and Ethereum take center stage, Solana (SOL) quietly establishes itself as the new asset to watch. Driven by strong technical signals and record interest in derivative markets, the crypto is now assigned a target of $1,000. However, behind this bullish momentum lies a paradox: real activity on the network is collapsing. Between speculative frenzy and on-chain exhaustion, Solana intrigues as much as it questions.

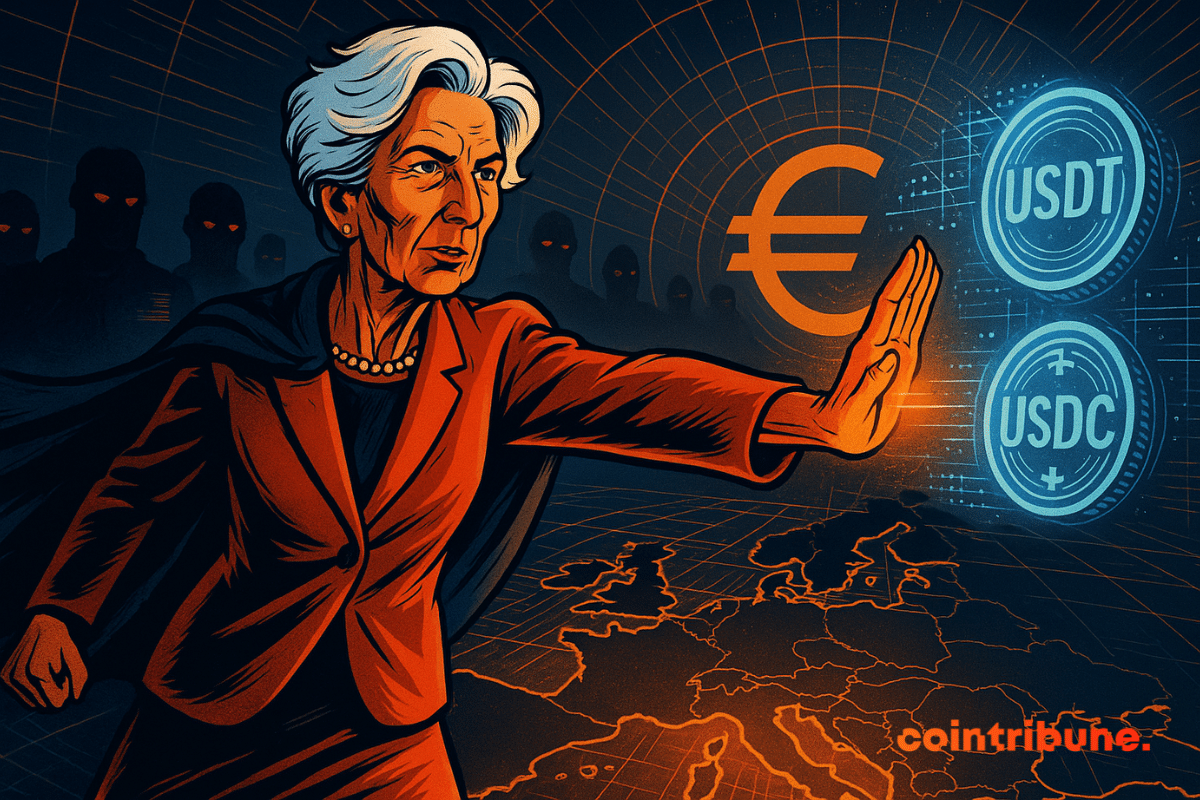

The President of the European Central Bank steps up against dollar-backed stablecoins. During a conference in Frankfurt, Christine Lagarde demanded "firm" guarantees for any foreign issuer wishing to operate in the EU. A strong signal of European fears regarding the growing influence of the greenback in cross-border digital payments.

The United States has leaped to the second spot on the Chainalysis 2025 Global Adoption Index due to regulatory clarity and increased ETF adoption. India retained its leading position as the third consecutive global leader, and Pakistan, Vietnam, and Brazil were the top five. This ranking reflects a broader trend, crypto adoption is expanding rapidly in both mature markets with clearer rules and emerging economies where digital assets address real financial needs.

American crypto-focused prediction platform Polymarket has been granted operational greenlight after the U.S. Commodity Futures Trading Commission (CFTC) issued a no-action notice to two entities linked to the company. This action follows the application for regulatory relief in July.

A BNB whale fell victim to a $13.5 million phishing attack on Venus Protocol. The platform paused operations, but the stolen funds were later recovered.

Trust Wallet has added tokenized U.S. stocks and ETFs, allowing users to trade real-world assets directly from their wallets.

In July 2025, a Microsoft vulnerability exposed over 400 public organizations, including the U.S. agency that manages the nuclear arsenal. Hospitals paralyzed, schools ransomed, and a post-quantum deadline now set: 2025 reminds governments that they won't win the cybersecurity race with late patches and centralized architectures. Faced with this reality, one question emerges: how do we build a truly resilient trust infrastructure?

American crypto exchange Kraken has completed an ambitious tour of France with 21 stops across the country. Stated objective: move beyond major metropolitan areas to meet users in the regions. This unprecedented initiative reveals a deeper strategy for conquering the French market.