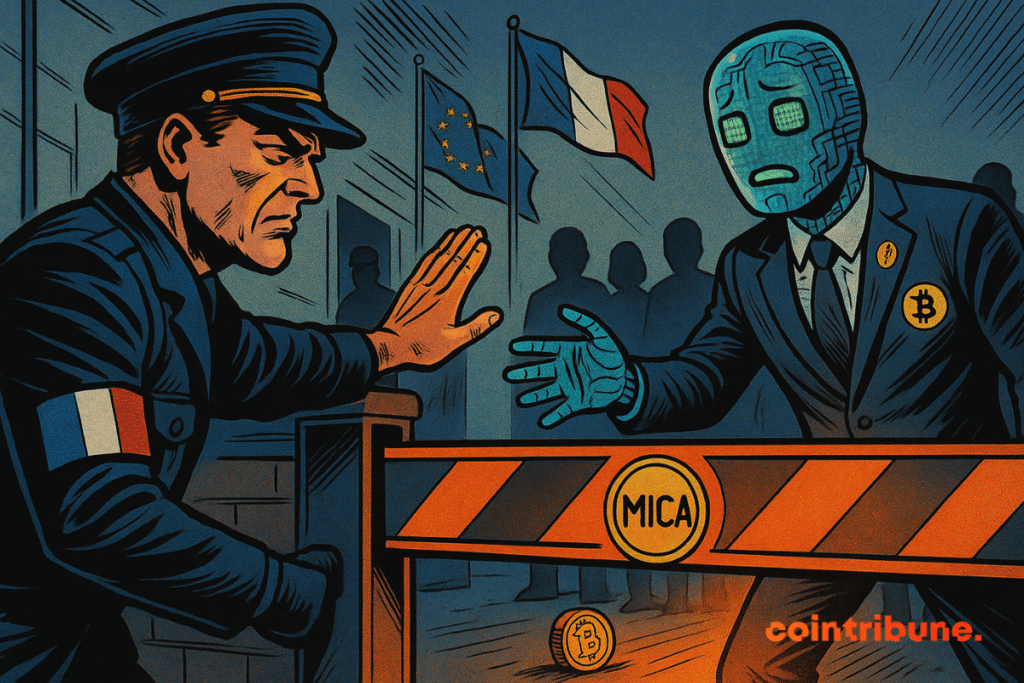

France Threatens to Block Crypto Firms Under MiCA Regulation

While the MiCA regulation promised harmonization of the European cryptocurrency market, France warns of its flaws. Result: The country could block access for certain foreign crypto companies to its market. More details in the paragraphs below.

In brief

- France could refuse the MiCA passport to crypto companies licensed in countries considered too lenient.

- Paris demands centralized European supervision to avoid uneven crypto regulations among EU member states.

France Raises the Threat of Blocking the MiCA Crypto Passport

The MiCA regulation came into effect at the end of 2024. It allows crypto platforms licensed in a European Union member state to operate throughout the zone thanks to a “European passport”. This tool is supposed to facilitate harmonization. Yet, it opens the door to a race for the most lenient regulation.

The president of the Financial Markets Authority (AMF), Marie-Anne Barbat-Layani, expressed her concerns about this “regulatory shopping.” According to her, some crypto companies deliberately seek more permissive jurisdictions to bypass French requirements. Paris therefore does not rule out blocking certain European passports. A measure described as a nuclear option by the leader.

Behind the scenes, several players fear ineffective supervision for crypto platforms with complex and cross-border structures. In the short term, France therefore wants to strengthen the power of ESMA (the European crypto regulator) to prevent a weakening of control at the continental level.

Towards a Redefinition of ESMA’s Role in Crypto Asset Oversight

The AMF is not alone in raising the alarm. Along with its Italian (Consob) and Austrian (FMA) counterparts, it advocates transferring competencies to ESMA. A joint position paper reveals strong disparities in the application of the regulation among national crypto regulators. This undermines the unity of the MiCA project.

Concrete cases illustrate these differences. For example, Malta granted a license to a crypto platform without sufficiently assessing the risks. Luxembourg, meanwhile, has already granted approvals to crypto giants like Coinbase and Gemini.

The three countries also call for a strengthening of the MiCA framework:

- increased control of operations outside the EU;

- better cybersecurity requirements;

- clarification on token management.

If these reforms succeed, ESMA could become the main arbitrator of the European digital asset market.

In any case, the current standoff around MiCA could well redefine regulatory balances in Europe. Meanwhile, crypto platforms navigate between opportunity and uncertainty.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.