The issuer of the world's largest stablecoin, Tether, has just acquired a minority stake in the prestigious Italian club Juventus. This announcement marks a new milestone in the convergence between the crypto sector and professional sports.

Crypto News

Bitcoin struggles to stay above 100,000 dollars, but traders are becoming increasingly optimistic about a possible rise. Dr. Sean Dawson, head of research at Derive, now assesses the probability that the crypto will reach 125,000 dollars by the end of June at 44.4%, a significant upward revision from previous forecasts.

The story of Ripple (XRP) is one of a regulatory battle that has kept the entire crypto industry on edge. After years of tug-of-war with the Securities and Exchange Commission (SEC), an unexpected change has just shaken the market: the U.S. regulator has officially acknowledged the requests for XRP and Dogecoin ETFs filed by Grayscale. Is this just an administrative procedure? Perhaps, but for investors, this signal was enough to propel the price of XRP by 20% in just a few days, with open interest now flirting with 4 billion dollars. Behind this surge, the entire future of altcoin ETFs is at stake, and traders are closely monitoring the upcoming decisions from regulators.

The crypto sector is used to forecasts and bets on the future. But when a probability rises to 81%, it stops being mere speculation and becomes a credible scenario. This is the case with the XRP ETF, whose approval in the year 2025 seems increasingly plausible, according to the bets recorded on Polymarket. While American regulators are still struggling to clarify their position on cryptocurrencies, this sudden rise in forecasts is noteworthy.

The consolidation phase of Bitcoin seems to be coming to an end. While recent fluctuations have not disrupted retail demand, the enthusiasm of retail investors remains palpable. Several signals indicate that a trend reversal could be imminent, offering new bullish prospects.

Coinbase is aiming for a digital gold future: $10 trillion on the blockchain with Washington at the forefront. Armstrong: prophet or charlatan?

The altcoin market is experiencing an unusual situation at the beginning of 2025. While some tokens are showing price increases, the marked absence of retail investors is hindering the emergence of a true altcoin season, according to several industry analysts.

Bybit, one of the giants of the crypto ecosystem, has just scored a decisive point: its removal from the AMF's blacklist in France. But behind this victory lies a complex regulatory puzzle, between European ambitions and Asian challenges. A strategic twist that reveals the new priorities of an actor ready to do anything to conquer Europe.

The Solana network continues to assert itself in the crypto universe. According to recent data, Solana's cross-chain bridges have reached a total volume of $10.1 billion in inbound transactions, marking an impressive increase of 114% in one year.

Hong Kong continues to strengthen its position as a major crypto hub. Local authorities recently confirmed that Bitcoin (BTC) and Ethereum (ETH) can now be used to prove the wealth of investors applying for an investment visa. This decision marks a significant advancement in the integration of cryptocurrencies into the regulatory and financial framework of the region.

Like a stock-market phoenix, GameStop is rising again: a simple Bitcoin rumor and the stock soars. Masterful bluff or the beginning of a financial revolution?

February 12 and 13, 2025, will be marked as two particularly difficult days for Bitcoin, which had to face a double piece of bad news on the American inflation front. The queen of cryptos, which had already fallen below $95,000 on Wednesday, continues to struggle to maintain this critical level.

Crypto: Tether strikes back after JPMorgan's predictions of a massive Bitcoin sell-off. Should we be worried? Analysis.

The Ethereum ecosystem is currently experiencing significant growth in its TVL (total value locked), reaching unprecedented levels since 2022. On February 11, 2025, Ethereum's TVL reached 21.8 million ETH, marking its highest level since October 2022, representing an 11% increase from the previous month. A momentum that unfortunately may not benefit ETH.

The crypto market is going through a period of tension, and the numbers speak for themselves. While Bitcoin is moving in a zone of uncertainty, exchange-traded funds (ETFs) based on the first cryptocurrency are experiencing a concerning wave of withdrawals. In just three days, $494 million has left these investment vehicles, indicating a weakening of buying momentum and a growing climate of caution among investors. The ETFs, which were supposed to bring new stability to the Bitcoin market, are now struggling in the face of an increased downward trend. Between institutional caution and declining investor enthusiasm, the situation highlights tensions that could weigh on Bitcoin's evolution in the coming weeks.

Investors have always viewed gold as a safe haven. But what happens when that very refuge falters? In recent weeks, the gold market has been going through a troubled period, fueling growing distrust among traditional investors. At the heart of the tensions are abnormally long delivery times from the Bank of England and questions about the system's actual capacity to honor its commitments. In the face of this uncertainty, an alternative stands out: bitcoin, a cryptocurrency that escapes logistical constraints and manipulation risks. Jeff Park, an expert at Bitwise Asset Management, has not minced his words, announcing a possible massive capital migration from gold to crypto. A paradigm shift is emerging, with consequences that could reshape global investment.

Bitcoin, the unalterable rock of the market, watches the altcoins sink under the weight of sales. Uncertainty looms, the suspense rises: bullish explosion or abyssal fall?

The dynamics of power are evolving at a breakneck speed in the crypto sphere. Today, it is BNB (Binance Coin) that is making headlines by surpassing Solana (SOL) in terms of market capitalization. With a 13% increase in a week, BNB has reached a market cap of over 104 billion dollars, thus dethroning SOL. However, this performance goes beyond mere numbers. It is part of a broader context marked by technological advancements, bold marketing strategies, and a shift in investor perception. Let's dive into the details of this remarkable rise.

The line between traditional finance and the world of crypto continues to blur. Franklin Templeton, a giant in asset management with $1.6 trillion under management, takes another step towards integrating blockchain and announces the extension of its tokenized US money market fund (FOBXX) on Solana. This strategic move, which comes against a backdrop of rising tokenized financial assets, could represent a turning point in the institutional adoption of this technology. After already launching this fund on Ethereum, Avalanche, and several layer 2 blockchains, the American company is now betting on Solana, an infrastructure that has managed to appeal beyond its initial reputation as a playground for memecoins.

According to the latest data from the analysis platform Santiment, XRP is experiencing significant growth in its network, marked by a notable increase in the number of active wallets. This positive trend sharply contrasts with the situation of Bitcoin, which has lost over 277,240 active wallets in the past three weeks.

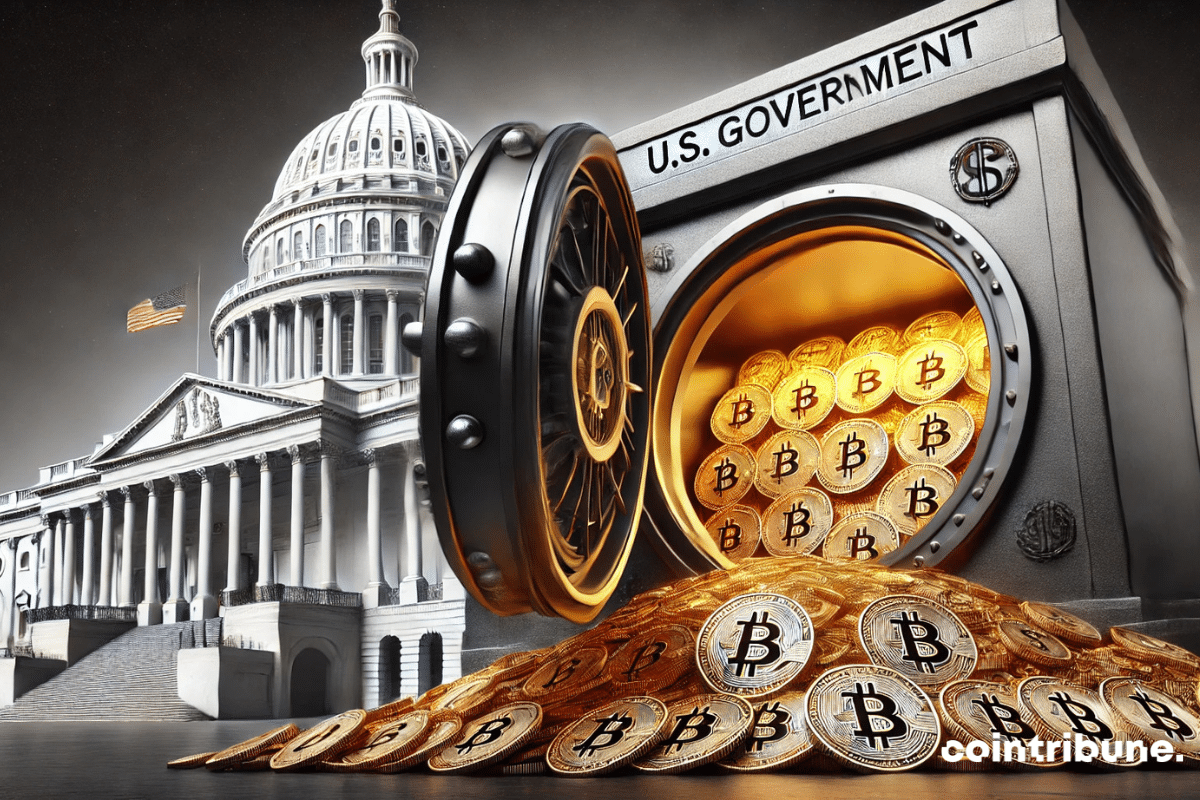

A VanEck analysis reveals that about twenty U.S. states are considering acquiring reserves in bitcoin, for a potential amount of 23 billion dollars. This initiative could lead to the purchase of 247,000 BTC if the bills are adopted.

813,000 washed-out investors, a memecoin that evaporates, 100 million in the pockets of insiders. The SEC looks the other way, Trump smiles: welcome to the Wild West of crypto!

The crypto sector continues to generate increasing interest among institutional investors, according to Cathie Wood, founder and CEO of ARK Invest. In a recent analysis, she noted that Bitcoin could experience a meteoric rise, potentially reaching $1.5 million by 2030. This forecast is driven by increased adoption of digital assets by financial institutions.

The impact of the latest U.S. inflation data was immediately felt on the crypto market this Wednesday, February 12, 2025. Bitcoin fell below the $95,000 mark following the announcement of higher-than-expected inflation, while Donald Trump continues to push for a reduction in interest rates.

Uniswap takes a major new step with the launch of Unichain, its Layer 2 blockchain on Ethereum. This announcement comes just a few days after the successful deployment of its version 4 on twelve major networks.

And if Bitcoin rose from its ashes to brush against unexplored heights? As gold sets records, reaching apocalyptic peaks, eyes turn toward the king of cryptocurrencies. Between transient turbulence and hopes fueled by precious metals, BTC oscillates between doubt and brilliance. But one burning question remains: is the prophecy of a historical peak in the coming weeks credible, or merely a speculative mirage?

The upcoming release of inflation data in the United States could be a key factor for the price of bitcoin. According to a recent report by 10x Research, a decrease in the Consumer Price Index (CPI) could trigger a new bullish rally, bringing BTC closer to its historical highs.

The crypto ecosystem is constantly evolving, marked by cycles of euphoria and correction. In recent months, the excitement for memecoins, these highly speculative assets, seemed to indicate a new wave of transient exuberance. However, a shift is occurring: Bitcoin and layer 1 blockchains are gradually taking center stage again, a phenomenon that could mark a decisive turn for the market. Investors appear to be turning away from risky bets in favor of more robust and functional assets, a shift that is not insignificant. According to Santiment, traders' attention is now focusing on fundamental cryptos, to the detriment of ultra-speculative assets. This reorientation could reflect a collective awareness.

Like rats leaving a sinking ship, 605 million dollars in ETH are making their escape. Should we see this as an imminent rebound or a planned shipwreck?

Goldman Sachs investment bank significantly strengthened its presence in the crypto market in the fourth quarter of 2024, with a dramatic increase in its investments in Bitcoin and Ethereum ETFs. This is a surprising development for a bank that had recently shown a critical stance on cryptocurrencies.