Bitcoin, once called a bubble, is now creating millionaires in series: 145,000 in one year. Bankers are grinding their teeth, speculators are popping champagne.

Finance News

The Federal Reserve has made its decision, but without certainty. According to Jerome Powell, no interest rate adjustment will be without consequences. While several central banks have started a cycle of rate cuts, the Fed chairman warns of a strategic deadlock. In a context where inflation remains resilient and employment wavers, every decision becomes risky. A strong signal sent to the markets closely watching every word from the Fed as a decisive monetary turning point approaches.

World Liberty Financial appears poised to build on its market entry by pursuing utility-focused growth. The crypto venture, backed by the Trump family, has outlined plans to issue a debit card and retail application, as per recent reports.

Economy: JPMorgan anticipates tensions on the Fed and integrates stablecoins without fearing for its deposits. We tell you more here!

While retail investors tremble at the slightest dip, corporate whales are devouring millions in bitcoin. Coincidence? Or a new strategy from the "private central bankers" of crypto?

At Saylor's, the vaults overflow: 639,835 bitcoins in reserve! While Wall Street grimaces, Strategy plays the global treasurer of an increasingly coveted digital gold.

With renewed confidence in the crypto market following macroeconomic events, the decentralized finance (DeFi) niche is showing strong performance, as evidenced by its recent growth. The latest data now shows that the sector could be poised to touch the previous peak it reached nearly four years ago.

Promised for 2026, the digital euro is already causing waves: Lagarde sees sovereignty, Navarrete calls it a useless gadget, and banks fear a digital bank run.

Two crypto platforms are fiercely competing: Kalshi captures the volumes, Polymarket buys respectability. Sports betting, regulators, and billions join the prediction feast.

As the conflict in Ukraine drags on, the European Union opens a new front: that of cryptos. For the first time, Brussels plans to directly sanction crypto platforms, integrating these decentralized infrastructures into its economic measures against Moscow. A discreet but strategic shift, integrating cryptos into the realm of international pressure tools.

What will China do if the United States truly start selling gold to embrace bitcoin?

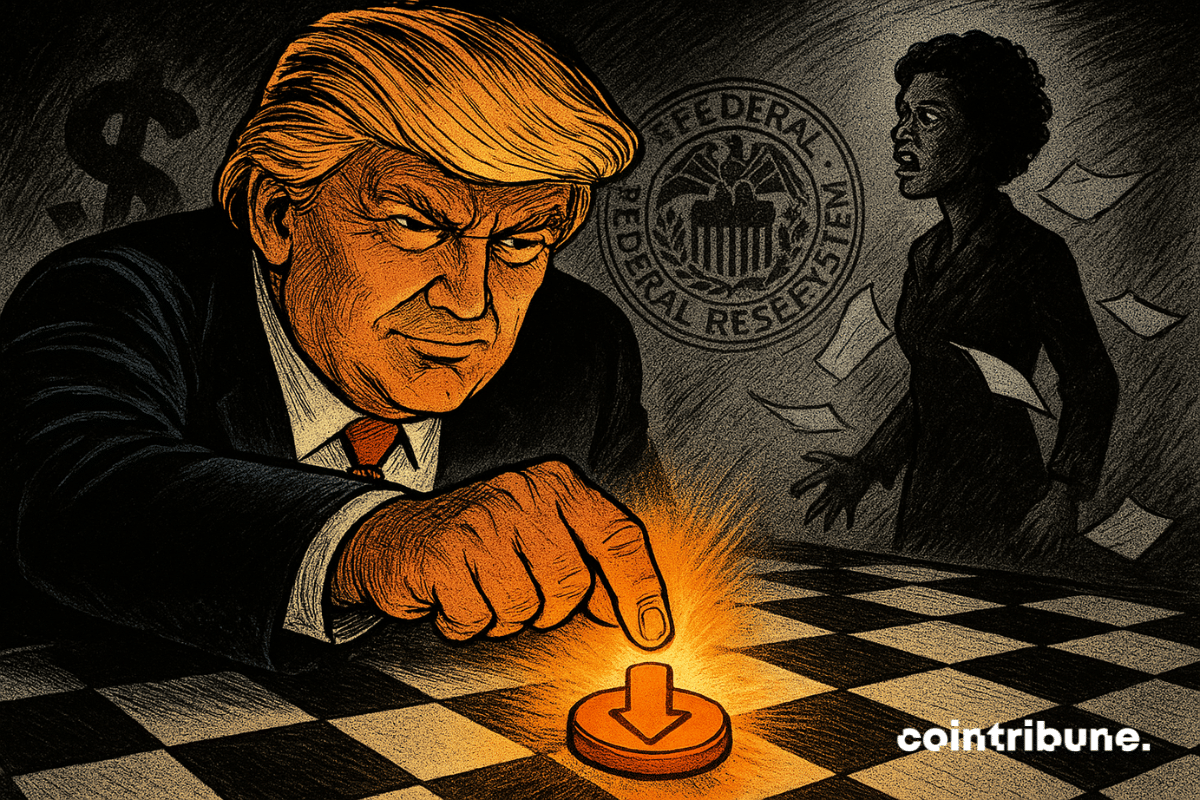

Powell cuts timidly, Trump shouts louder than ever, and crypto cheers. In Washington, the FED lowers its arms, while Bitcoin and stablecoins revise their choreography.

The internationalization of the Chinese currency is no longer a fantasy. The growth of international payments in yuan is skyrocketing. Bitcoin is lurking.

Ethereum network stakers are facing record-long exit times, with about 2.5 million ETH ($11.25 billion) pending withdrawal from the validator set, according to dashboard reports. Given this backlog of unsettled transactions, the waiting time for withdrawal has stretched to more than 46 days—the longest in the network's history. For comparison, the last big peak in wait time, which occurred in August, only had an 18-day wait.

With the U.S. Federal Reserve set to deliberate on a possible rate cut, appetite for risk assets is building. In fact, investors have poured over $600 million into crypto-focused exchange-traded funds (ETFs) in the past seven days. Capital rotation in Ethereum ETFs has also resumed, following periods of exits.

Washington dreams of a digital safe: one million bitcoins in the national reserve. But between orange ties, Republican promises, and empty coffers, the crypto political saga unfolds with suspense.

Banks are screaming disaster, Coinbase responds with numbers: stablecoins do not swallow deposits, but happily crunch the $187 billion in banking fees.

Nakamoto Holdings becomes the symbol of a fatigue in the Bitcoin treasuries model. Discover all the details here!

Fitch has downgraded France's sovereign rating from AA- to A+, mainly due to governmental instability and difficulties in reducing the public deficit. This situation reveals the failure of the French government, but also massive interventions by the European Central Bank (ECB).

Tokenized real estate takes on a new dimension with RealT, an innovative platform that disrupts traditional rental investment codes. By fractionating American real estate properties into digital tokens on blockchain, this company based in Florida and Delaware opens the doors of international real estate to all investors, regardless of their financial capacity.

Standard Chartered sounds the alarm: crypto treasury companies, built around the accumulation of Bitcoin, Ethereum, and Solana, face a major crisis. The collapse of the mNAV weakens their business models and signals a consolidation phase where only the strongest players will be able to continue growing.

The US markets celebrated Monday the confirmation of a preliminary agreement between Washington and Beijing regarding the future of TikTok. Oracle, the favorite to acquire the Chinese platform, jumped more than 3% while the S&P 500 crossed the symbolic threshold of 6600 points for the first time.

PayPal plays the magician: a simple link, and hop, your cryptos fly by SMS. But behind the sparkling innovation, who really holds the strings of your digital payments?

Bitcoin wavers, whales sell, Wall Street sulks... and Strategy laughs. The former MicroStrategy continues to fill its vaults, defying volatility and skeptics of a crypto market that is always surprising.

President Donald Trump has renewed his efforts to remove Federal Reserve Governor Lisa Cook just days before the central bank is expected to deliver its first rate cut in nearly a year. The case has turned into a controversial legal battle that is now overlapping with one of the most significant policy decisions in the US economy. As the administration continues with its appeal, new evidence looms to erode its claims and heightens its political and financial stakes.

European regulators are targeting $17.5 billion of cat bonds held in UCITS funds. ESMA considers these securities, exposed to natural disasters, too complex and risky for retail investors. If the European Commission follows this recommendation, a wave of forced sales could shake an already strained market.

While the crypto market stalls, Arthur Hayes tempers the prevailing impatience. The cofounder of BitMEX believes that criticisms directed at bitcoin ignore a fundamental lever: global monetary policy. In a recent interview, he suggests that continued money printing by central banks could extend the crypto bull cycle until 2026. This macroeconomic analysis contrasts with the widespread pessimism and invites investors to reassess their benchmarks.

As the war in Ukraine enters a critical phase, Donald Trump throws a wrench in the diplomatic pond. The American president stated that no new sanctions against Moscow would be taken as long as NATO countries continue to buy Russian oil. This statement exposes the persistent fractures within the Alliance and revives the question of its strategic coherence towards Russia.

This Wednesday, September 17, the US central bank is expected to cut its key interest rate by 25 basis points. A decision already priced in by the markets, but far from trivial, as inflation remains above target and employment slows down. Behind this monetary shift, investors are looking for a signal. Temporary shock or catalyst for a new cycle? From bitcoin to gold, through Wall Street, all assets are watching Jerome Powell’s verdict.

Recent chatters within crypto chat rooms indicate that prediction platforms Polymarket and Kalshi are exploring ways to raise capital, with Polymarket aiming for a higher valuation than Kalshi. Interestingly, this comes as decentralized betting begins to catch the eyes of top firms within the crypto space.