Over the past week, Litecoin has risen by more than 30%. The LTC price tested $116, marking a new annual ATH.

Finance News

It's not the first time that financial giants have made optimistic statements about bitcoin. But this time, the CEO of the world's largest asset management company openly declared his preference for bitcoin “over investing in gold, […] bitcoin is an international asset”. In the wake of this statement, bitcoin is on the verge of a bull market. As stock market indices consolidate, bitcoin is on its highest levels of the year. But is bitcoin “digital gold”? And what are the aims of this financial giant?

For the time being, Gary Gensler is untouchable. He will continue to reign supreme in the offices of 100 F Street, NE Washington D.C. Especially in the absence of solid arguments against his policies. Yet the crypto community has never stopped finding a breach in the SEC's fortified line. Perhaps this latest initiative by pro-crypto lawyers will eventually succeed?

In 2017, Larry Fink, CEO of asset management company BlackRock was scathing about bitcoin. In particular, he criticized the crypto queen as a mafia asset, useful for laundering money. Now, his views on bitcoin's usefulness have changed dramatically.

As a crypto with great potential, ADA is one of those digital assets that perform remarkably well even in the midst of a bear market. Its resilience in a tumultuous market is impressing many investors. Particularly concerned about the future of altcoin, analyst Dan Gambardello predicts an imminent uptrend for this cryptocurrency. He recently shared his thoughts on the future of the digital asset with Twitter users.

Bitcoin is still sitting on $30,000, but the bullish pressure is palpable. Here are the top 5 (crescendo) bullish factors.

Bitcoin has experienced explosive price phases in recent weeks. According to several analysts, the asset's price should continue to rise despite the market's circumstances. Economist Alex Krüger is among those who believe in this prospect.

Ether (ETH) could get off to an explosive bullish start this month, in a context that seems favorable to a bullish recovery. If confirmed, this crypto could reach $2500.

According to this crypto analyst, bitcoin (BTC) could see an explosion in value in July. He points to a pattern reminiscent of the asset's price structure in 2020. Departing from the traditional four-year cycle theory, this analyst sees things from a different angle. But only time will tell if this month will be as fruitful as November 2020 for BTC.

As the BTC halving approaches, bull run predictions are back in full swing. Tim Draper predicted a $250,000 bitcoin by 2022. But not everything went according to plan for the queen of cryptocurrencies. The crypto-enthusiast billionaire has rectified his earlier prediction.

Bitcoin is entering a new era with the introduction of Sats Names. This innovative and rapidly expanding naming standard is reshaping the contours of the Bitcoin ecosystem. What is this major innovation, and how is it shaping the cryptocurrency landscape?

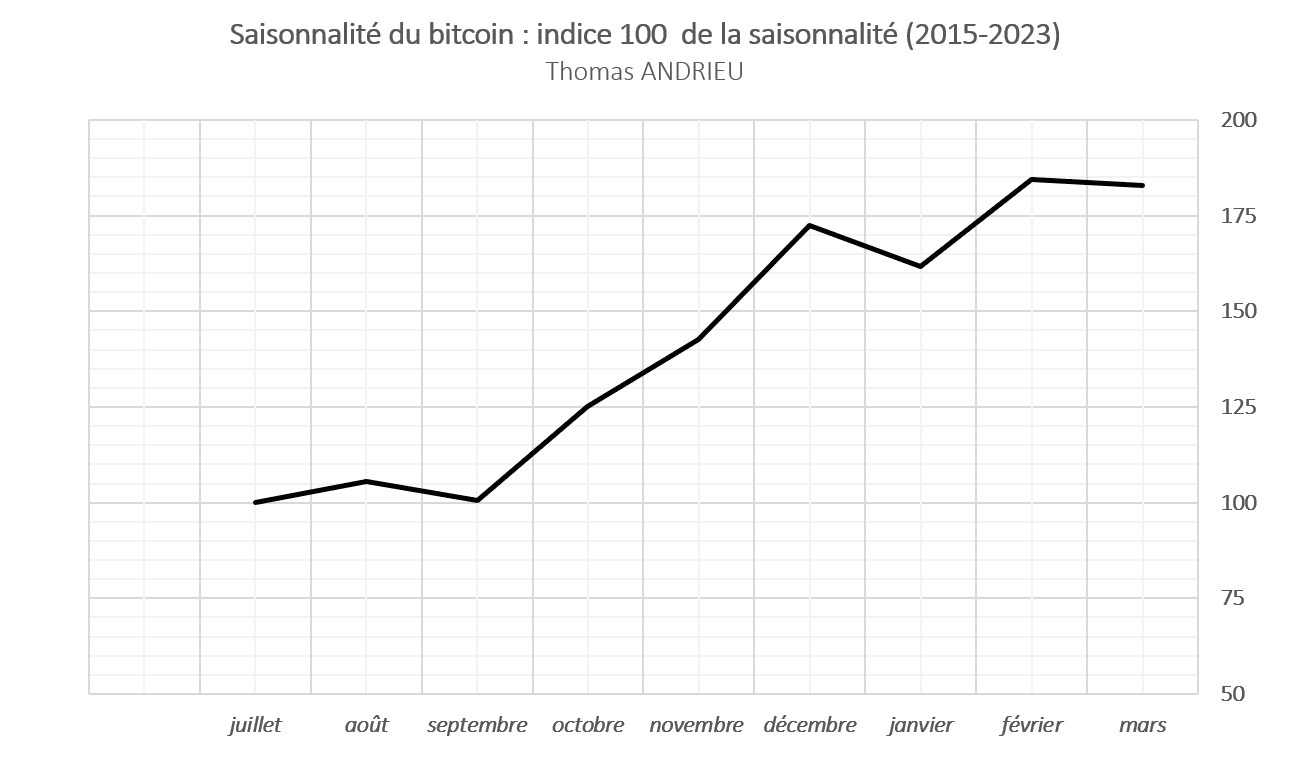

Is seasonality a myth? In this article, we will attempt to give an ideal overview of bitcoin's comparative behavior since 2015. We'll focus on monthly performance, effectively excluding shorter variations. The study of seasonality thus shows that October, February and July are generally the most reliable and best-performing months. Will this be the case in the coming months?

After a week of consolidation, bitcoin (BTC) is at a decisive point. Bullish indicators suggest that the 25% rise could continue. Nevertheless, it's important for investors to be cautious, as a decline is also a possibility.

According to analyst Rekt Capital, three altcoins could soon be on a bullish trend. The well-known trader believes that litecoin (LTC), ATOM and SAND are all showing warning signs of an imminent rise. He shared his thoughts with his followers on Twitter.

Secret sales of staking rewards: End of the road for Sui Network?

Ether (ETH) stabilizes around $1850, potentially offering a buying opportunity. The uptrend could indeed continue in a context favorable to cryptos.

Making European banks more resistant to crises and less permeable to unsecured cryptocurrencies was the aim of lawmakers from the 27-nation bloc meeting today. At the same time, an agreement was reached in favor of reforms to banking regulations.

Recently, BlackRock filed a Bitcoin ETF application with the SEC. The process is still in its early stages, but already seems to mark a major change for bitcoin.

It's quite a paradox! The man who shook the Kremlin does not come from the opposition camp, nor from outside. Yevgeny Prigozhin is a very close friend and Vladimir Putin's "former Swiss Army knife". He dared to challenge the powers that be with a short-lived rebellion backed by some 5,000 men. A situation quickly resolved by Putin, and one that has been emulated by Russian crypto-enthusiasts.

Last week, bitcoin underwent a 19% rise. The price of the leading cryptocurrency rose from around $26,000 to $31,500, setting a new annual ATH.

In the financial markets, gold and bitcoin are two distinct but highly valued asset classes. Gold benefits from long-standing trust, while bitcoin has managed to establish itself as an essential asset despite the fluctuations it undergoes. According to some experts, both assets have advantages that can be asserted for a long time to come.

Bitcoin (BTC) recently broke through the psychological $30,000 barrier, which seems like a good time to buy. Here are some interesting buying areas.

The price of Bitcoin recently soared following a series of events triggered by BlackRock's ETF request. Some analysts believe this marks the beginning of a bull run for the flagship cryptocurrency. However, one of them remains cautious about this prospect. Here's why.

The news about the queen of cryptocurrencies is closely followed, and predictions about its future are multiplying by the day. The digital asset has been experiencing an upward trend for the past few days, much to the delight of Bitcoiners. Many analysts agree that it is destined for better days. Renowned investor Michael Saylor is among those who believe this and has recently shared the reasons why he believes Bitcoin (BTC) will continue to dominate the cryptocurrency market for a long time.

Performance in the first half of 2023 has been largely supported by liquidity. Furthermore, the good news in June was the agreement reached on the debt ceiling limit. It has been increased until 2025, which subsequently reassured a number of financial market operators. It's not the agreement itself on the ceiling limit that's worth keeping an eye on, but rather the impacts of a liquidity squeeze on Bitcoin and the crypto market for the second half of the year.

Altcoins, innovative digital assets with a wide range of functionalities, offer promising investment opportunities that are attracting a multitude of investors. The latter are particularly drawn to the exceptional performances achieved by these alternative currencies during the "altcoin season", to the point of sometimes overshadowing Bitcoin (BTC), the first and main cryptocurrency. In response to this phenomenon, many analysts and investors seek to draw comparisons between Bitcoin and altcoins, in order to refine or enhance their investment strategies. Specialist research firm K33 Research has also embarked on this analytical journey.

A ship doesn't set sail across the ocean without the clear guidance of its captain, nor without keeping an eye on the uncontrollable forces of nature. Likewise, the bitcoin ship is preparing to set sail on its next bullish voyage, with two essential factors on board: regulatory clarity in the US and falling inflation.

ADA, Cardano's native cryptocurrency, is currently showing a bullish trend despite the bear market and is trading around $0.30. However, some signals indicate that a potential decline in the asset's valuation cannot be ruled out.

BlackRock recently filed a Bitcoin ETF application with the SEC. According to several analysts, the process could be beneficial for the price of Bitcoin (BTC) by attracting more institutional investors. Recent trends point to an increase in institutional investors' confidence in the crypto market.

After plummeting to $25,000, the Bitcoin price is skyrocketing. Many see this dynamic as a positive development. However, Peter Schiff disagrees. The investor criticizes the skyrocketing price of the flagship cryptocurrency. He believes the trend will only last for a short time.