Never before have so many bitcoins stayed with the same owners for such a long time. Everyone is eagerly awaiting the halving.

Theme Bitcoin (BTC)

As the deadline for the US debt approaches, analyses, predictions, and speculations are multiplying. Well-known in the cryptocurrency industry, Arthur Hayes has also joined the discussion. The founder of BitMEX, who currently heads Maelstrom Capital, predicts explosive times for the financial markets and a rise in Bitcoin.

In the world of cryptocurrencies, smart and persistent investors are usually rewarded. However, there are a few rare exceptions to this principle. Sometimes, individuals manage to succeed by implementing a well-thought-out approach. Discover the success story of this new crypto whale.

Vladimir Putin expressed his support for a “decentralized” financial system at the Eurasian Economic Union Forum held in Moscow.

Institutional funds specializing in cryptocurrencies continue to face capital outflows for the fifth consecutive week, according to the latest report from CoinShares. With a withdrawal of $32 million last week, the total outflows now amount to $232 million. Despite a decrease compared to previous weeks, institutional investors remain cautious towards cryptos. Let's explore the reasons behind this trend.

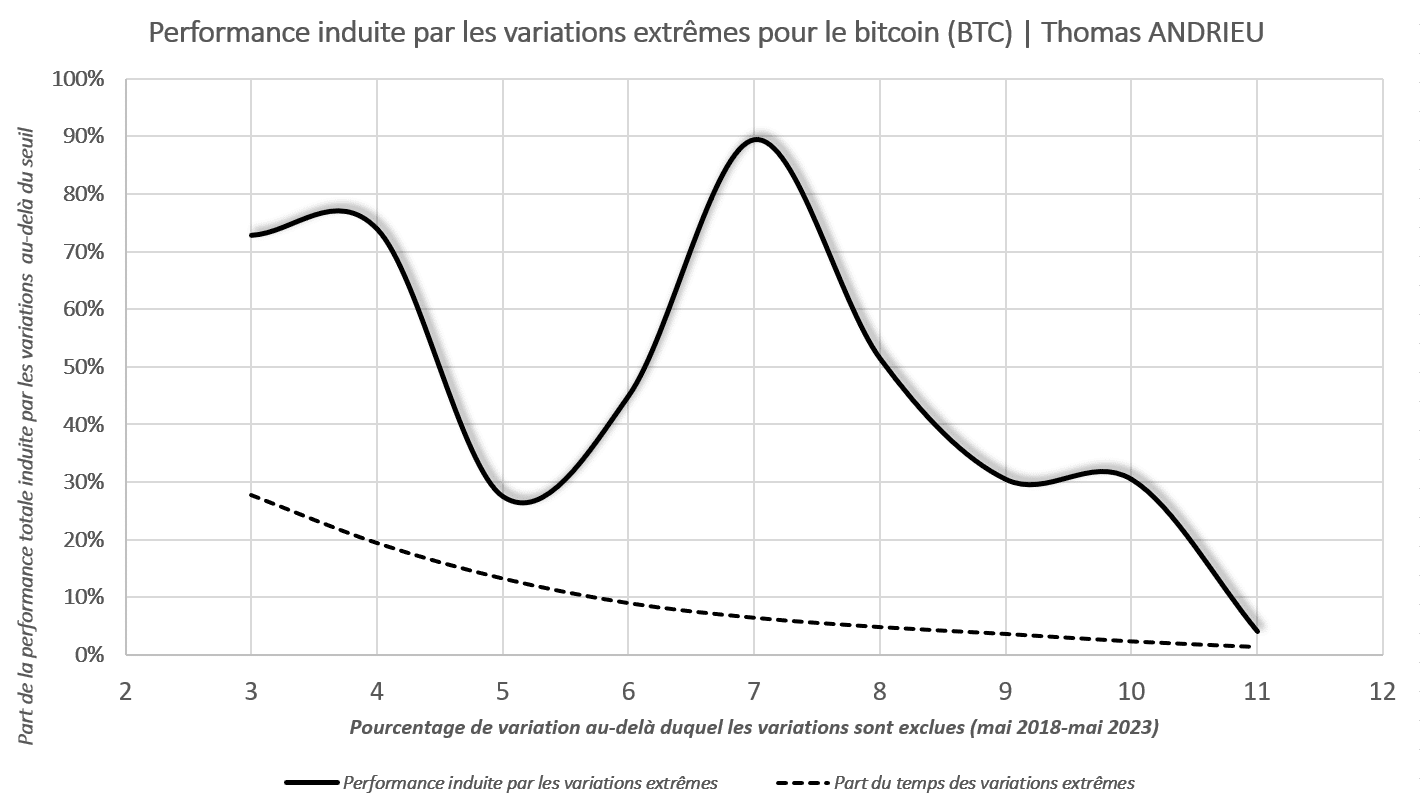

Our study focuses on the role of rare variations in Bitcoin's (BTC) performance. This exclusive study reveals some astonishing findings. In particular, it appears that 7% of the time explains up to 90% of Bitcoin's (BTC) performance. This clearly deviates from what one would expect and aligns with the conclusions of our previous article. Our study aims to identify the “rare” variations that explain Bitcoin's (BTC) performance.

The International Organization of Securities Commissions (IOSCO) is an association of 130 agencies responsible for overseeing securities and futures. It recently launched a consultation process that is expected to conclude by the end of July. In fact, it published 18 policy recommendations for consultation on May 23 for the management of crypto markets. Here's what they are.

During the Bitcoin 2023 conference in Miami, Michael Saylor, Executive Chairman and Co-founder of MicroStrategy, shared his thoughts on the superiority of Bitcoin. He also took the opportunity to express his views on crypto regulation in the United States, questioning whether the uncertainty and regulatory ambiguity are deliberate.

The recent developments in the Bitcoin (BTC) market have raised numerous questions among analysts about the future evolution of the flagship cryptocurrency. While many forecasts predict a sharp decline in Bitcoin (BTC) value, some observers stand out by displaying a more optimistic perspective. One such individual is the renowned crypto analyst Kaleo, whose recent analysis we invite you to discover.

In recent years, the Securities and Exchange Commission (SEC) has fiercely opposed the creation of a Spot Bitcoin ETF. Some exchange-traded fund (ETF) experts believe that this trend is not going to change anytime soon.

Many people are currently betting on Bitcoin to cope with the ongoing financial crisis that has been plaguing us for several months now. However, Mike McGlone, Bloomberg's macro strategist analyst, wanted to warn them: the price of Bitcoin (BTC) may experience an exponential drop in the coming months.

Currently, Bitcoin (BTC) seems to be facing difficulties, struggling to gain momentum. Indeed, the price of the flagship cryptocurrency is having a hard time surpassing the $27,000 mark. This situation is causing a lot of concern within the Bitcoin community. There are now many uncertainties regarding the future trajectory of the crypto's price. However, some analysts are already predicting a bleak future for the queen of cryptos. One of them, renowned strategist Michael J. Kramer, recently expressed particularly pessimistic views on the future price of BTC.

Several analysts had predicted that the conversational AI, ChatGPT, could have a positive impact on the crypto industry. The tool has been put to the test to predict the possibilities of price growth in cryptocurrencies. Here is its forecast.

In January 2023, our statistical analysis of Bitcoin (BTC) opened up the possibility of a strong bullish recovery in its price.

Always at the center of speculation, Bitcoin continues to make headlines. Ever since it regained momentum, almost all analysts expect the asset to explode. Perhaps not to the same extent, as some believe Bitcoin is undervalued.

While Bitcoin is booming at the Miami Beach conference, Mike McGlone has made an unpleasant prediction for crypto investors. According to his analysis, the flagship cryptocurrency will suffer a decline if the conditions mentioned below happen.

Right now, the dollar is at the center of global economic debates. Some have already announced that the era of American currency hegemony is coming to an end. And in the currently bleak economic context of the country, some are considering how to adapt to this anticipated change. Bitcoin could contribute significantly to this.

Will the United States default on its debt? Sooner than we think. But to whom? China, Russia…

Even today, crypto adoption in El Salvador is not unanimous. In the United States, for example, American senators have just submitted a new bill. The goal: to monitor the crypto adoption (specifically Bitcoin) in El Salvador and assess its economic impact.

Bitcoin (BTC) is regularly the subject of speculation. It's normal: not only is the flagship cryptocurrency highly valued, but it has also been gaining momentum in recent weeks. Some believe that the asset is destined to reach a new milestone.

What is a seed? Is it possible for someone to guess it? What are the chances of that happening? What is the seed used for?

The social analytics platform LunarCrush has conducted a cryptocurrencies analysis in terms of social engagement, revealing that Pepecoin (PEPE) competes with well-established major cryptocurrencies. Let's take a look at the results of LunarCrush's analysis.

The volatility of cryptocurrencies leads us to accept that the bull run is far from being linear at all. Bitcoin, which started this year with impressive performance, allowing it to flirt with $31,000, has now dropped back to $27,000. Such conditions lead Rekt, a notorious crypto analyst, to predict a decline for the queen of cryptocurrencies.

A popular crypto strategist has predicted a significant drop in altcoins, while also updating their outlook on Pepecoin (PEPE) and Avalanche (AVAX), a rival of the Ethereum (ETH) network. The analyst, known by the pseudonym Sherpa, informed their 195 Twitter followers that altcoins could plummet by up to 50%.

It's no longer a secret that Bitcoin has outperformed expectations in recent months. The numbers clearly show a surge in its value. Meanwhile, despite gloomy economic and financial circumstances, Bitcoin has not experienced a significant drop. According to some experts, there might be a reason for this.

An anonymous analyst predicts an increase in the value of the SUI token, suggesting buying at around one dollar. They also recommend investing in Pepe, despite its controversial reputation, and believe that Chainlink could be a good buying opportunity once it emerges from its long accumulation period. Keep a close eye on them!

So far, it has been a year of strong performance for the leading cryptocurrency, with prices generally on the rise. And for many analysts and Bitcoin enthusiasts, this trend is expected to continue. However, others are a bit more cautious due to the economic context and its impact on the crypto market.

Crypto exchange crashes like FTX have always been preceded by massive currency transfers. However, some observers claim that large volumes of Bitcoin have been leaving exchanges such as Binance recently. Is this the beginning of the end for this giant and its peers?

Nicholas Merten, a widely followed crypto analyst, recently sounded the alarm by stating that the massive sale of stocks by investing legend Warren Buffett does not bode well for financial markets, including Bitcoin. According to him, the current rally in the cryptocurrency is sorely lacking in price models to support a short-term uptrend, making a significant price increase unlikely.

Despite the ongoing global economic crisis, the cryptocurrency space continues to grow. Evidence of this can be seen in the number of countries that have already adopted cryptocurrency. However, there are still others who remain skeptical about promoting investment in Bitcoin. Such as Ireland. According to the governor of the Central Bank of Ireland, Bitcoin is a Ponzi scheme.