Bitcoin reaches $99,562, breaks a key resistance level, and is charging straight towards $100,000! However, what surprise awaits BTC? A rise to $120,000 or an imminent correction to $92,000? Let's explore technical trends and perspectives together.

Theme Bitcoin (BTC)

Financial markets are on the brink of a new cycle of monetary easing, marked by strategic decisions from major central banks. Following the American Federal Reserve, which began reducing its key interest rates last September, it is now the People's Bank of China (PBOC) that is preparing to take the lead. Beijing plans to lower its interest rates further to stimulate the economy and counter the heightened deflationary pressure on the yuan, a phenomenon that worries Chinese authorities and weighs on investor confidence. In light of this situation, Arthur Hayes, co-founder of BitMEX and macroeconomic analyst, anticipates a chain reaction in the financial markets. He asserts that the combination of a looser monetary policy in China and a favorable environment in the United States will enhance the appeal of alternative assets, particularly bitcoin and cryptocurrencies. According to him, this injection of liquidity, coupled with a reorientation of institutional capital, could trigger a massive rally in the cryptocurrency market during the year 2025.

The year 2024 has been marked by a spectacular rise in the value of cryptocurrencies, with Bitcoin reaching an historic peak of $108,135. However, this meteoric growth has also led to a troubling increase in kidnappings and extortions targeting crypto traders and investors.

Metaplanet, a Japanese company specializing in bitcoin, recently announced its ambition to acquire 10,000 BTC by 2025. This initiative marks an important step in the company's strategy to strengthen its position as a leader in bitcoin treasury in Asia, placing it in direct competition with MicroStrategy.

Like a cut breath, Bitcoin hesitates below $100,000. Fewer sales, more waiting: where is it going?

Bitcoin reached a historic milestone in 2024. In just one year, $19 trillion flowed through its network, an absolute record that marks the end of two years of declining transaction volumes. This spectacular recovery reflects the return of investor confidence, driven by several major events. The approval of Bitcoin ETFs in the United States facilitated the entry of institutional capital, while the April 2024 halving reinforced the scarcity of BTC, which fuels demand. Meanwhile, the network has significantly strengthened, with a hashrate at an unprecedented level of 1,000 exahashes per second. Behind these staggering figures, a shift is taking place: Bitcoin is consolidating its status both as a store of value and as a global transactional infrastructure, raising questions about its future and its role in traditional finance.

Bitcoin, the weary hero, struggles against fierce illiquidity. In January, analysts are gazing at the stars: $105,000 or false hope?

For some time now, MicroStrategy has established itself as the leading company in Bitcoin. With a bold strategy that combines financial innovation and conviction, it is once again in the spotlight with an ambitious proposal: to raise 2 billion dollars to acquire more bitcoin.

The Bitcoin network has just reached a historic milestone, achieving a record hashrate of 1,000 exahashes per second (EH/s) on January 3, 2025. This symbolic threshold represents an unprecedented acceleration of computing power mobilized to secure the blockchain, as the mining sector undergoes a phase of strategic expansion. Over the span of a year, the network's hashing capacity has doubled, increasing from 510 EH/s in January 2024 to this unprecedented level, illustrating the scale of investments in the industry.

Cryptos continue to captivate the attention of the financial world, but the true players in this market often lurk in the shadows: the whales. These investors with colossal resources influence trends and open new paths. This time, it is in the realm of AI-based tokens that an anonymous whale has struck hard, raking in 11.5 million dollars in less than three weeks.

The bitcoin market is going through a turbulent period at the beginning of 2025, despite recent historic highs. According to a report by Bravo Research, a correction down to $80,000 could represent a strategic buying opportunity for investors.

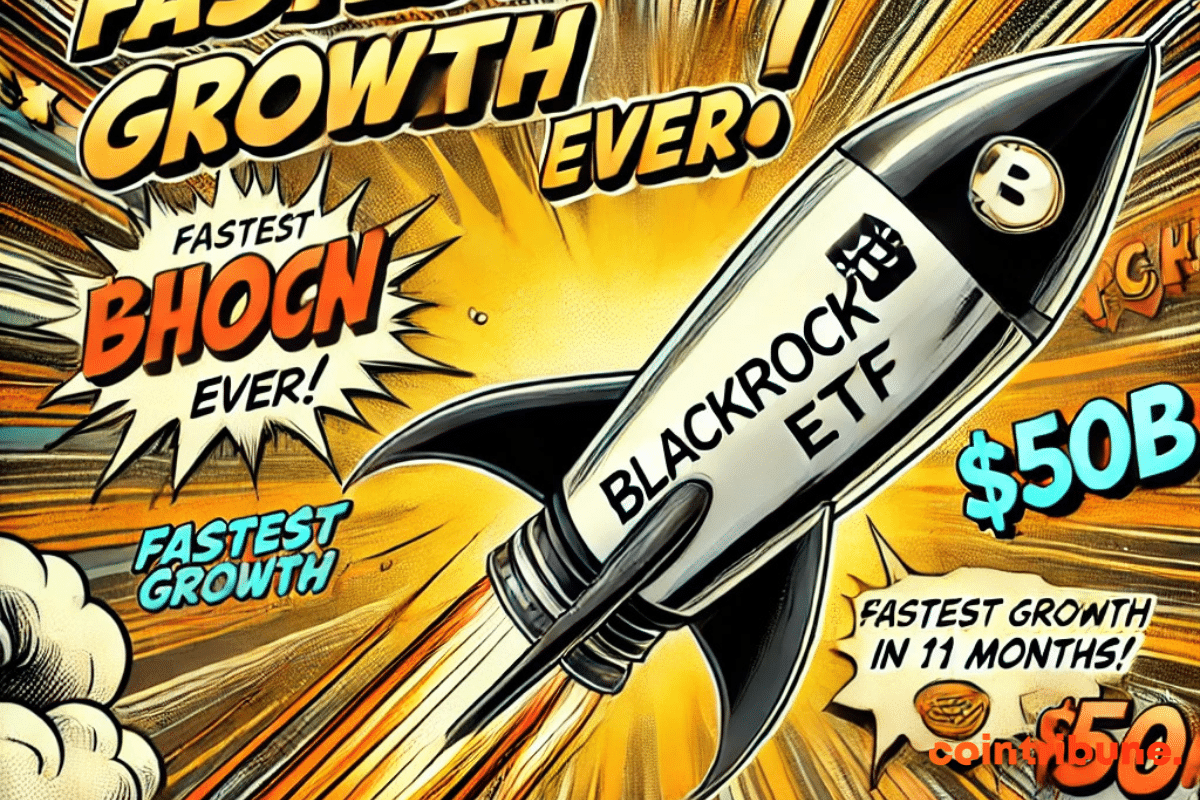

BlackRock's Bitcoin ETF sets a historic record with $50 billion in assets in 11 months, revolutionizing the ETF market and strengthening institutional adoption of Bitcoin.

Like beacons in the crypto night, American ETFs illuminate the path for Bitcoin towards dizzying heights. The oracles whisper: $200,000, and perhaps more!

In December 2024, BlackRock's Bitcoin (BTC) exchange-traded funds (ETFs) recorded new record net outflows reaching 188 million dollars! Meanwhile, Ethereum (ETH) ETFs attracted over 2.5 billion dollars in net inflows. This trend marks a notable shift in the preferences of institutional investors.

Experts at Steno Research forecast that 2025 will mark a major milestone in the history of cryptocurrencies. According to their report, Bitcoin could reach $150,000 and Ethereum $8,000, unprecedented levels. These projections are based on an increasingly favorable regulatory framework, coupled with growing institutional adoption. Meanwhile, economic conditions, characterized by falling interest rates and improving liquidity, bolster growth prospects. The introduction of ETFs dedicated to Bitcoin and Ethereum in the United States, which are expected to attract massive investments, illustrates this positive momentum. As the sector moves towards greater recognition, it may redefine its standards and offer new opportunities for innovation.

How to know how much you can earn from BTC mining? Discover the answer in this comprehensive guide to bitcoin mining. Before knowing how much bitcoin mining can yield, one must first understand how this activity works.

Are you interested in bitcoin (BTC) mining but don't know how to get started? Mining can be an effective way to earn cryptocurrency income, provided you have the right hardware. GPUs, or graphics cards, are powerful processors designed to quickly handle complex calculations. Faster than CPUs, they can extract larger amounts of bitcoins. By the end of this article, you will have all the knowledge you need to start mining bitcoins with your graphics card!

Mining involves using powerful computers to solve complex problems and validate transactions on the blockchain. Among the equipment used to mine Bitcoin, ASICs are certainly the most widespread in the industry. Discover everything you need to know to get started with ASIC mining!

Are you interested in mining Bitcoin (BTC) and hesitating to start with a processor (CPU)? Know that it is entirely possible to mine Bitcoin using the processing power of your computer. In fact, it is an easy way to get started in cryptocurrency mining, as you do not need expensive hardware or special knowledge. In this article, we will guide you through your first steps in CPU mining.

Have you ever heard of FPGA? It is a type of hardware used for mining cryptocurrency, whose popularity continues to grow. This article covers all the necessary steps to mine Bitcoin (BTC) with this device. But before diving into the heart of the matter, let’s start by defining the concept and what the advantages and disadvantages of this practice are.

Are you looking for the best software to mine Bitcoin (BTC)? If so, you're in luck! In this article, we will give you an overview of some of the most popular software for Bitcoin mining. We will explain the different features of each solution and discuss the advantages and disadvantages to help you decide which one is best suited to your needs.

The Stratum mining protocol is an essential component of the Bitcoin (BTC) network. It allows mining software to connect efficiently and securely to the blockchain, optimizing the mining process. Developed in 2012, Stratum has since become the most popular protocol used for mining bitcoins. In this post, we will explore the definition of this technology and the reasons why it is so important for Satoshi Nakamoto's network.

Bitcoin is a popular cryptocurrency that facilitates secure and decentralized exchanges. Each transfer of bitcoins from one user to another is a mathematically verified operation to ensure the reliability of exchanges. Let's see how these calculations take place in the network and how they contribute to the bitcoin mining process.

The hash rate or hashing rate in French is a measure that indicates the mining power of a computer per second. It is closely monitored by blockchain professionals because it allows for measuring the speed of Bitcoin mining. In summary, it is a data point used to evaluate the number of crypto-assets that can be mined with a given hardware. How is this rate measured? How does it vary? And what is its importance for miners and investors?

Bitcoin mining is the process by which new units of bitcoins (BTC) are created. It is an effective method if you want to acquire Bitcoin. But before you dive into this activity, you may be wondering how long it takes to generate BTC. In this article, we will explore this question in depth. You will discover, among other things, how difficulty, hash rate, and other parameters influence this metric.

Bitcoin is a digital currency that has quickly gained popularity in recent years. One of the key components of Bitcoin is the hash value, which is a unique identifier associated with each transaction and each Bitcoin block. In this article, we will explore what a hash value is and why it is so important for the Bitcoin blockchain.

The hashprice is a very important metric for crypto miners. It is particularly useful when it comes to determining the profitability of their operations. Therefore, if you are interested in Bitcoin (BTC) mining, or if you are simply a cryptocurrency enthusiast, you will probably want to learn more about it. This article explains in detail what hash price is and why it is so relevant in the crypto industry.

Initially, Bitcoin (BTC) mining was an activity practiced exclusively by a handful of insiders. However, over time, more and more people began to engage in it. As the phenomenon grew, mining farms started to emerge. In this article, we will explore what these platforms are, how they operate, and why they are interesting. We will also look at how they are powered, whether they are profitable, and what their future holds.

Building a crypto mining farm is an attractive solution for investors interested in cryptocurrencies. However, it requires a significant commitment in terms of time and money. Therefore, you must fully understand all the nuances surrounding this topic before diving in. In this article, we will review the essential elements for setting up a dedicated bitcoin mining farm. Next, we will show you how to maintain it to get the best return in the long term. Finally, we will discuss the best locations to start such a project as well as the costs associated with this type of installation.

Bitcoin mining is an activity that can be very lucrative when conducted properly. It requires basic knowledge, as well as mastery of certain skills. But above all, it necessitates the use of adequate resources. This implies a significant financial investment if you want to maximize your chances of profit. However, this is far from being accessible to everyone. Fortunately, there are ways to obtain BTC without spending money. In this article, we will review these different methods.