Bitcoin, once called a bubble, is now creating millionaires in series: 145,000 in one year. Bankers are grinding their teeth, speculators are popping champagne.

Ethereum (ETH)

Ethereum ETFs experience explosive growth as institutional demand reaches unprecedented highs. With 534 million dollars in daily inflows, these financial products now represent 15% of Ethereum's spot volume, compared to only 3% at their launch less than a year ago.

Exit Gensler, here comes Atkins: the SEC shifts from the brake to the accelerator. "Innovation exemption", multi-crypto ETP, stablecoins… Washington finally discovers that blocking costs more than moving forward.

Investors pulled back from Bitcoin and Ethereum ETFs on Monday, reflecting caution amid market shifts and pending economic data.

The crypto market has just endured one of its harshest shocks since the start of the year. In less than 24 hours, more than 407,000 positions were liquidated, wiping out over 1.5 billion dollars of bullish bets from order books. This quick correction, triggered by the domino effect of margin calls, shook the largest capitalizations while revealing the vulnerability of a market still dominated by leverage and massive speculative movements.

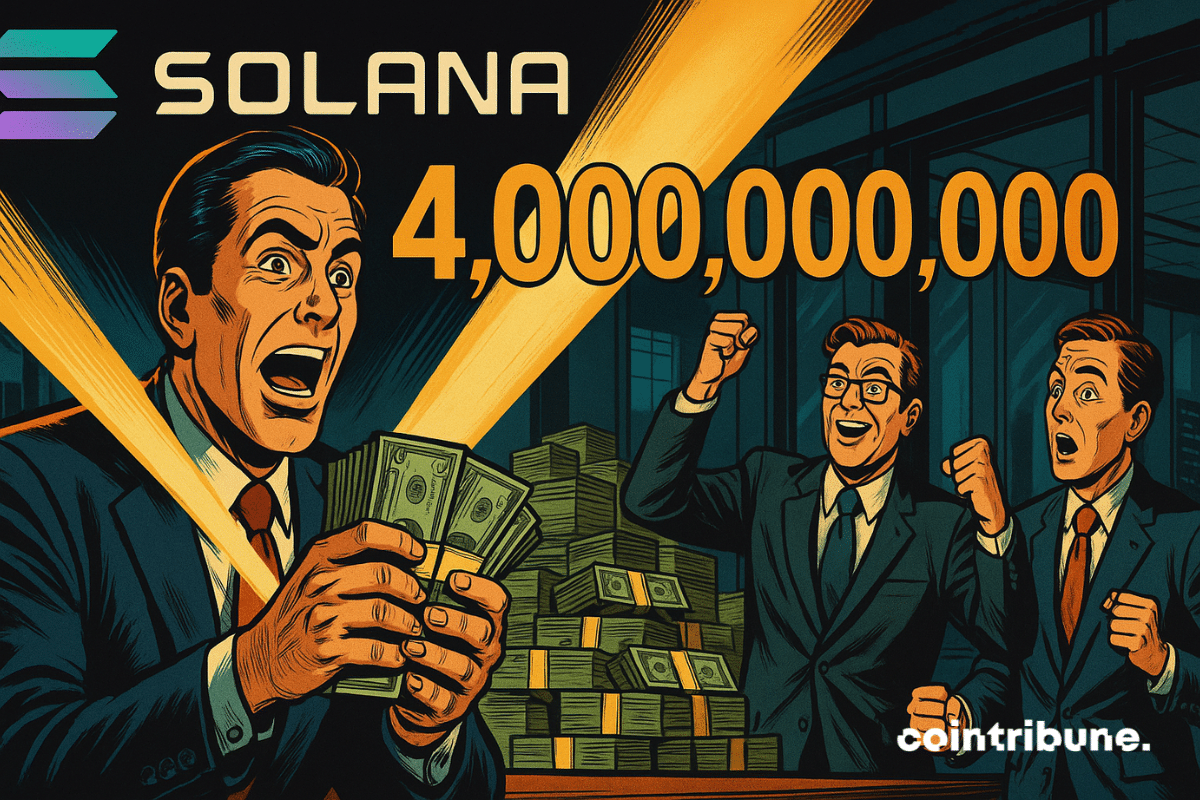

Solana does not need a three-piece suit to convince. The network is advancing, fast, and sometimes against the usual crypto habits. Pantera Capital says it bluntly: we are approaching a tipping point. The market, perhaps, has not yet adjusted its glasses.

The tokenized dollar machine has been reignited. Following the 25 basis points cut decided by the Fed on September 17, Tether accelerated the issuance of USDT. In total, 5 billion minted in eight days, including an additional 1 billion on September 19 on Ethereum, according to Onchain Lens. The timing is no coincidence: when the cost of money falls, the thirst for liquidity in crypto markets rises instantly.

What if Ethereum abandoned speculation to bet on stability? Vitalik Buterin proposes an unexpected strategic shift: making low-risk DeFi the main economic driver of the network. This is a sober vision, far from memecoins and NFTs, but potentially structuring. Like Google, whose search finances the ecosystem, Ethereum could find in this discreet but steady DeFi a durable foundation. This assumed disruption could redefine the priorities of the entire ecosystem.

MetaMask, the essential crypto wallet of the Ethereum ecosystem, could finally launch its token. Joe Lubin, CEO of Consensys, has just announced that this launch could happen "sooner than expected." A promise that excites traders… but also leaves many doubts.

Ethereum is about to reach a key milestone in its evolution. After months of intensive development, the Fusaka upgrade is now expected on December 3, 2025. This delay reflects a desire to balance security, scalability and attractiveness. What impact for users and investors?

Ethereum staking promises regular returns. But withdrawals are not instantaneous. Vitalik Buterin reminds why this delay is not a bug, but an essential safeguard for network security.

Powell cuts timidly, Trump shouts louder than ever, and crypto cheers. In Washington, the FED lowers its arms, while Bitcoin and stablecoins revise their choreography.

Ethereum network stakers are facing record-long exit times, with about 2.5 million ETH ($11.25 billion) pending withdrawal from the validator set, according to dashboard reports. Given this backlog of unsettled transactions, the waiting time for withdrawal has stretched to more than 46 days—the longest in the network's history. For comparison, the last big peak in wait time, which occurred in August, only had an 18-day wait.

Usually September bleeds, this time bitcoin smiles: +8%. But behind the miracle, the Fed pulls the strings and the crypto ecosystem holds its breath.

With the U.S. Federal Reserve set to deliberate on a possible rate cut, appetite for risk assets is building. In fact, investors have poured over $600 million into crypto-focused exchange-traded funds (ETFs) in the past seven days. Capital rotation in Ethereum ETFs has also resumed, following periods of exits.

Bitcoin and Ethereum are no longer the only ones capturing the attention of large institutional investors. Solana is now positioning itself as a new leading player among this elite. According to the latest data published by the Strategic Solana Reserve, corporate treasuries now hold more than 17 million SOL tokens, a value exceeding 4 billion dollars.

Standard Chartered sounds the alarm: crypto treasury companies, built around the accumulation of Bitcoin, Ethereum, and Solana, face a major crisis. The collapse of the mNAV weakens their business models and signals a consolidation phase where only the strongest players will be able to continue growing.

BitMine Immersion, chaired by Tom Lee, has solidified its position as the largest Ethereum treasury holder after its latest accumulation. The firm disclosed on Monday that its combined crypto and cash holdings now stand at $10.8 billion. The company’s aggressive acquisition strategy has pushed its Ethereum balance above 2.15 million ETH, highlighting its determination to dominate long-term blockchain investments.

PayPal plays the magician: a simple link, and hop, your cryptos fly by SMS. But behind the sparkling innovation, who really holds the strings of your digital payments?

Driven by 638 million dollars in inflows on its ETFs in one week, Ethereum establishes itself as the asset of the moment among institutional investors. However, technical and historical signals call for caution. With 99% of the supply currently in profit and a traditionally bearish September, the market could quickly turn.

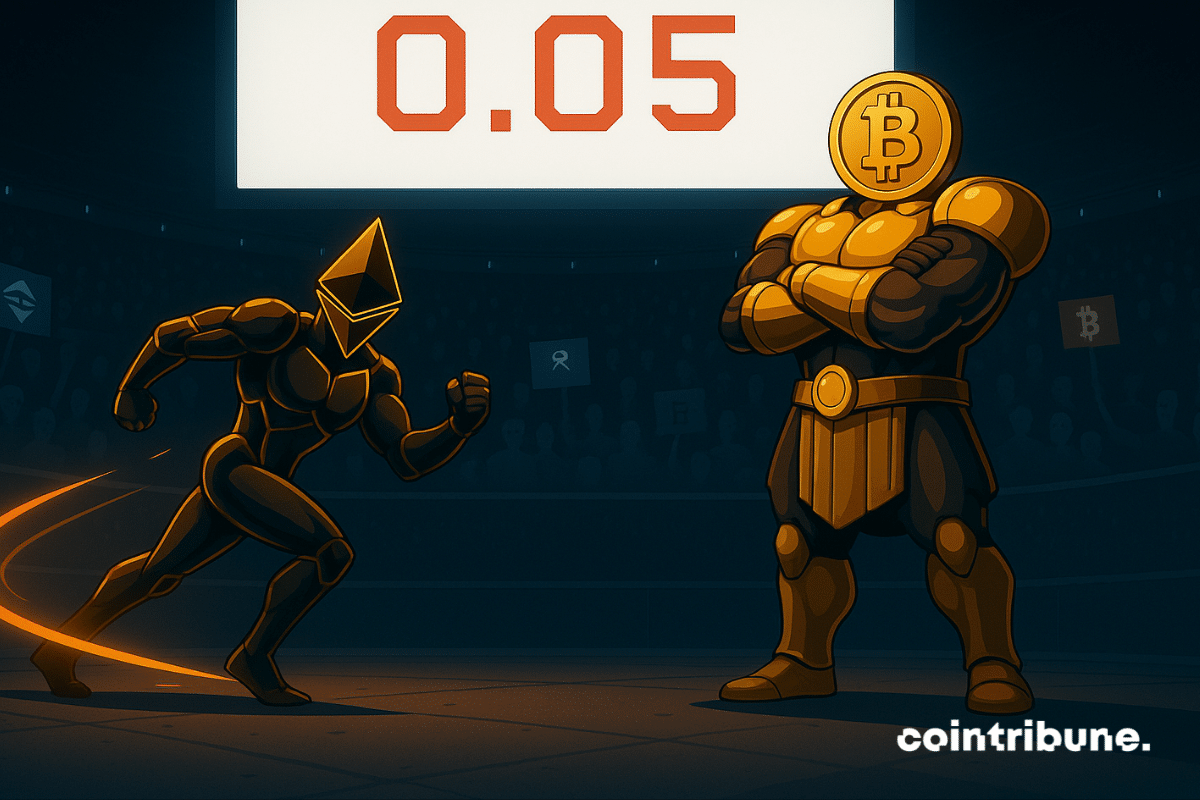

Ethereum’s ETH/BTC ratio remains under 0.05 as the cryptocurrency navigates price swings, investor activity, and market trends.

The crypto scene has once again proven that no protocol, no matter how popular, is completely safe. The Shibarium bridge, a strategic gateway between the Layer 2 of the same name and Ethereum, was the target of a swift flash loan attack that siphoned the equivalent of 2.4 million dollars. Behind this move, a maneuver both technical and psychological demonstrating the persistent flaws of decentralized security.

Ethereum envisions itself as a digital ghost: invisible transactions, secret votes… and regulators seeing red. The blockchain is preparing its revolution, between Big Brother and crypto utopia.

Ethereum shines in the crypto sky, but its brains struggle to make ends meet. Jackpot for the blockchain, crumbs for the coders: find the error, or the irony of the century.

The co-founders of Glassnode predict a new peak for bitcoin, Ethereum and Solana within a month. This announcement contrasts with the prevailing caution and reignites the debate on the strength of the bullish cycle. Between on-chain data and uncertain macroeconomic context, this projection immediately attracted the attention of investors, dividing the community between hope for an imminent record and fear of excess optimism.

Boom of RWA in crypto: +11% in one week. Focus on this revolution led by Ethereum and BlackRock.

Sharplink Gaming Inc. has kicked off a $1.5 billion share buyback plan as its stock trades below the company’s net asset value (NAV). The buyback signals a strategic effort to enhance shareholder value while market sentiment currently undervalues its Ether treasury holdings. The company, the second-largest Ether treasury firm, is leveraging this move to strengthen investor confidence and optimize capital allocation.

While the Fed blows hot and cold, the whales are dozing off… and here come the stablecoins, discreet stewards of the crypto market, imposing themselves as masters of the party.

Malicious actors are at it again, this time targeting the account of a well-known software developer's node package manager (NPM). Investigations revealed that the hackers added malware to popular JavaScript libraries, primarily attacking crypto wallets. However, after launching what industry sleuths describe as the largest supply chain attack in crypto history, the hackers managed to steal only $50 worth of crypto assets.

NFT sales dropped below $100 million in the first week of September, ending a two-month streak of strong summer performance.