After bouncing back, Bitcoin went through a consolidation phase before recently surpassing its last peak. Let's analyze together the future prospects of BTC's price.

Investissement

Stock Market: Are investors ready to seize the opportunities offered by falling rates? Analysis and explanation!

Amid revolutionary announcements, technological advancements, and regulatory turmoil, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic conflicts. Here is a summary of the most significant news from the past week concerning Bitcoin, Ethereum, Binance, Solana, and Ripple.

As artificial intelligence continues to disrupt technology and finance sectors, a new battle looms on the horizon. This Wednesday, August 28, Nvidia, the semiconductor and AI giant, will reveal its much-anticipated quarterly results. Crypto markets, particularly tokens specialized in AI such as Akash Network, Render Token, and Bittensor, are eagerly awaiting these announcements. Why the anxious wait? Because Nvidia's results could be a key indicator of the growing demand for AI and potentially impact the prices of these digital assets.

Tron outperforms the crypto market and reaches its highest annual level. Let’s examine the future prospects for the TRX price.

After a slight rebound following the crypto market downturn, Bitcoin has entered a consolidation phase. Let’s analyze the future prospects of BTC’s price together. Bitcoin (BTC) Price Situation After significantly dropping due to fears of a recession in the United States, Bitcoin hit a low at…

Jackson Hole raises doubt: the CAC 40 moves cautiously, investors await the Fed's verdict.

Among revolutionary announcements, technological developments, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battlefield of regulatory and economic battles. Here is a summary of the most significant news from the past week around Bitcoin, Ethereum, Binance, Solana, and Ripple.

Solana ETF: Discover why experts are predicting low demand and what it means for your crypto investments.

The Livret A, a true pillar of savings in France, has long been the preferred solution for protecting one's money from economic uncertainties. With a total outstanding amount of nearly 400 billion euros, it continues to attract a large part of the French population. However, financial advisors are sounding the alarm: do not exceed €3000 on your Livret A! But why this recommendation? And above all, what alternatives are available to you to obtain more interesting returns? Let's explore this crucial question for your finances together.

Sudden start, but a sudden brake for Ethereum ETFs, between losses and optimistic forecasts for the future.

The cryptocurrency market has been booming for some time now. And Bitcoin ETFs are at the heart of this dynamic. Financial giants such as Goldman Sachs and Morgan Stanley are increasingly interested in this new asset class. Discover how these institutions are investing massively in crypto-assets and the implications for the market.

Faced with the increasing restrictions imposed by the West, Russia and China are now exploring alternative ways to maintain their exchanges. As Chinese banks, once open to transactions in yuan, begin to close their doors to Russian payments for fear of reprisals, new methods are emerging.

In a market as unpredictable as that of cryptocurrencies, every fluctuation in economic indicators can trigger shocks of formidable magnitude. While some see Bitcoin as a safe haven against economic uncertainty, the reality of August 2024 once again demonstrates that this asset class remains profoundly sensitive to the headwinds of the global economy. In recent hours, the crypto market has been hit hard by a series of economic and institutional developments that have precipitated a brutal drop in prices.

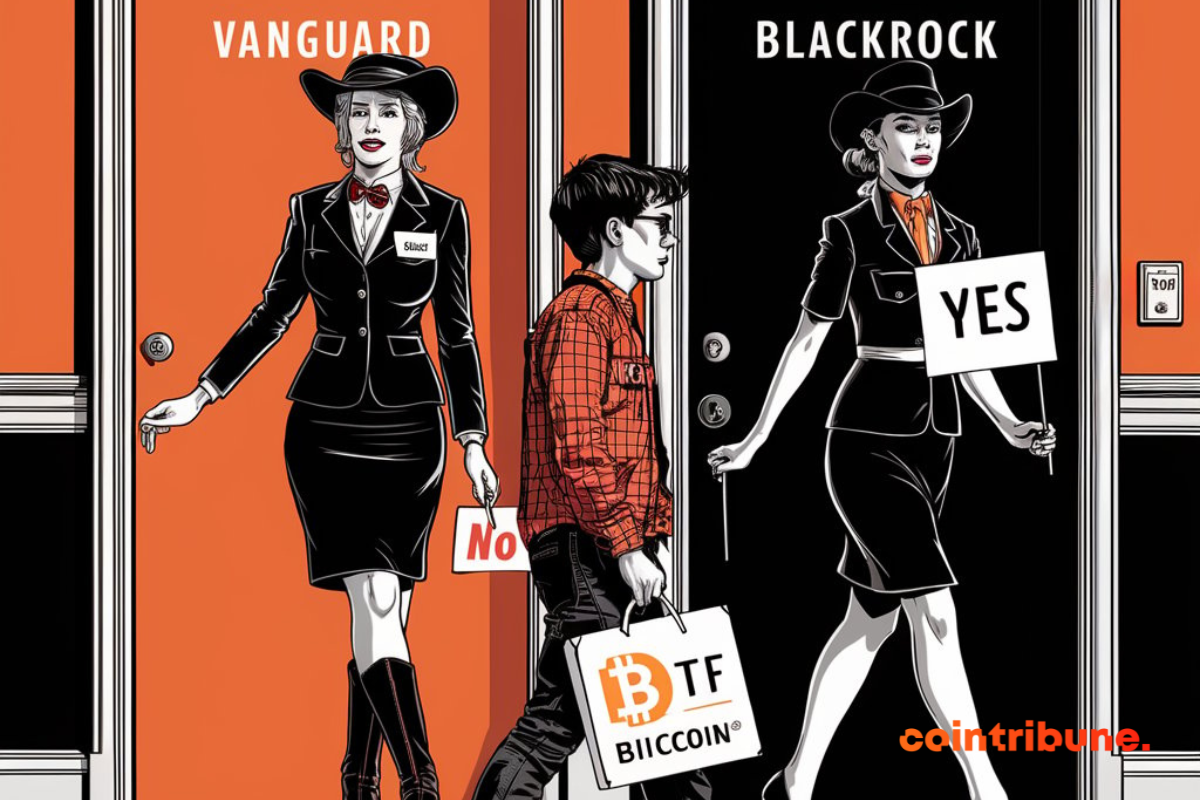

Vanguard on the crypto touch: "We do not copy BlackRock, nor their Bitcoin ETFs." There, it's said!

Cardano (ADA), long seen as a safe haven in the crypto ecosystem, is currently at the center of a perplexing contradiction: while its price is showing signs of a slight improvement, activity indicators on its network are declining significantly. This divergence, far from trivial, could be a sign of a deeper vulnerability and foreshadows turbulence ahead for this otherwise promising blockchain.

While the crypto market has been revised downwards, the Fantom cryptocurrency has recorded a drop of more than 78% since the end of March. Let’s examine the upcoming prospects for FTM’s price.

JPMorgan, BoA, Wells Fargo, and Citi predict Fed rate cuts. Discover the potential impact on the U.S. economy.

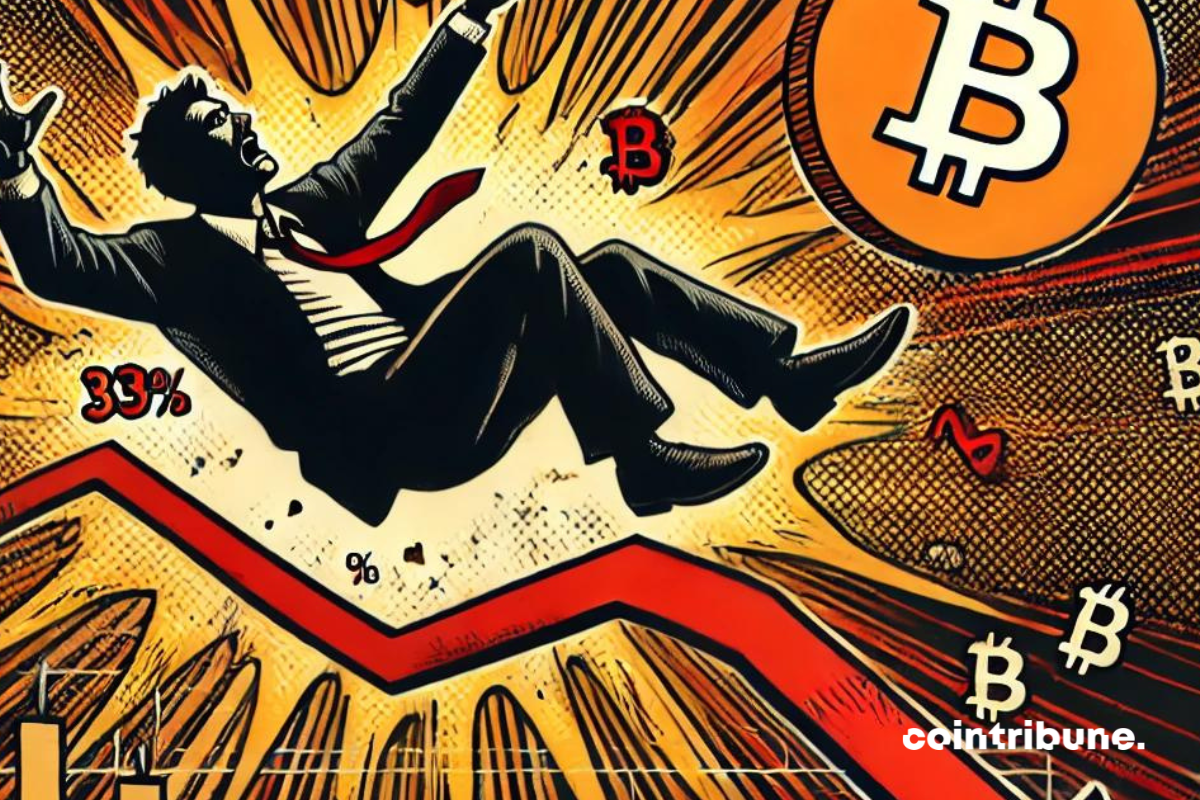

As Bitcoin seemed to have reached a plateau of relative stability, a recent report from Bitfinex Alpha reveals a much darker reality. Indeed, the leading cryptocurrency suffered a staggering 33% drop, a decline not seen since the collapse of FTX in 2022. However, what might be just a simple market correction actually hides troubling signals. The Mayer Multiple, a respected indicator that compares the current price of Bitcoin to its 200-day moving average, has reached historically low levels, while the MVRV ratio of short-term holders falls below the critical threshold. These indicators, highlighted in Bitfinex's latest report, point to extreme stress among new investors and hint at potential consequences for the entire cryptocurrency market.

While Bitcoin experienced a sharp drop on the first Monday of the month, it managed to rebound by more than 27% in the following days. Let's analyze together the future prospects of the BTC price.

XRP is back in the spotlight, not for yet another price fluctuation, but for what could be one of the most significant advancements in its recent history. Technical indicators are aligning in favor of a substantial bullish movement, bolstered by legal victories that are rekindling hope for holders of Ripple's native crypto. But…

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic challenges. Here is a summary of the most significant news from the past week regarding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Bitcoin is collapsing, ETFs are following. Investors are desperately looking for signs of recovery in this financial turmoil.

Seeing a meme coin surpass the world's second largest cryptocurrency over a one-year period remains as rare as it is eloquent. Shiba Inu (SHIB), long considered a mere fun derivative in the token universe, has recently defied expectations by showing annual growth higher than that of Ethereum (ETH). This success, although modest, embodies the profound and sometimes unexpected changes shaking up the crypto ecosystem.

In the ruthless world of cryptos, where each piece of news can sway markets and trigger waves of enthusiasm or panic, Hamster Kombat has just made a spectacular entrance. More than just a game, this ambitious project promises to redefine the sector by launching what could become the biggest airdrop in history.

The oil price war is rarely a simple commercial confrontation; it often conceals geopolitical stakes of far greater scope. Today, a new episode of this struggle is unfolding on the international stage, pitting two energy titans against each other: Russia and Saudi Arabia. As the world continues to struggle with the economic repercussions of the pandemic and the conflict in Ukraine reshapes the cards of global influence, these two major players from the BRICS are fiercely competing for dominance in the Asian market. Their maneuvers could well shake up the established order, both within OPEC and at the heart of global strategic alliances.

After being hit by the overall decline in the crypto market, Solana rebounds by over 45% in three days. Let's take a look at the upcoming prospects for the price of SOL.

Ethereum records a weekly decrease of 37% following the overall decline of the crypto market. Let's examine the future prospects for ETH together.

Markets have fallen historically in recent days. Are we heading towards a new descent into hell, or will the Fed lower its rates and launch a new stock market boom?

While Bitcoin reached $70,000 last week, the cryptocurrency has recorded a drop of more than 26% in a week. Let's analyze together the future prospects of BTC's price.