Nearly half of crypto experts express optimism about the future of AI tokens by 2025, according to a recent CoinGecko survey. This positive sentiment may signal favorable momentum for this sector valued at $23.6 billion.

Archive 2025

Crypto: a state fund for seized assets? Discover the bold proposal from the authorities in Russia and the hidden stakes of the project.

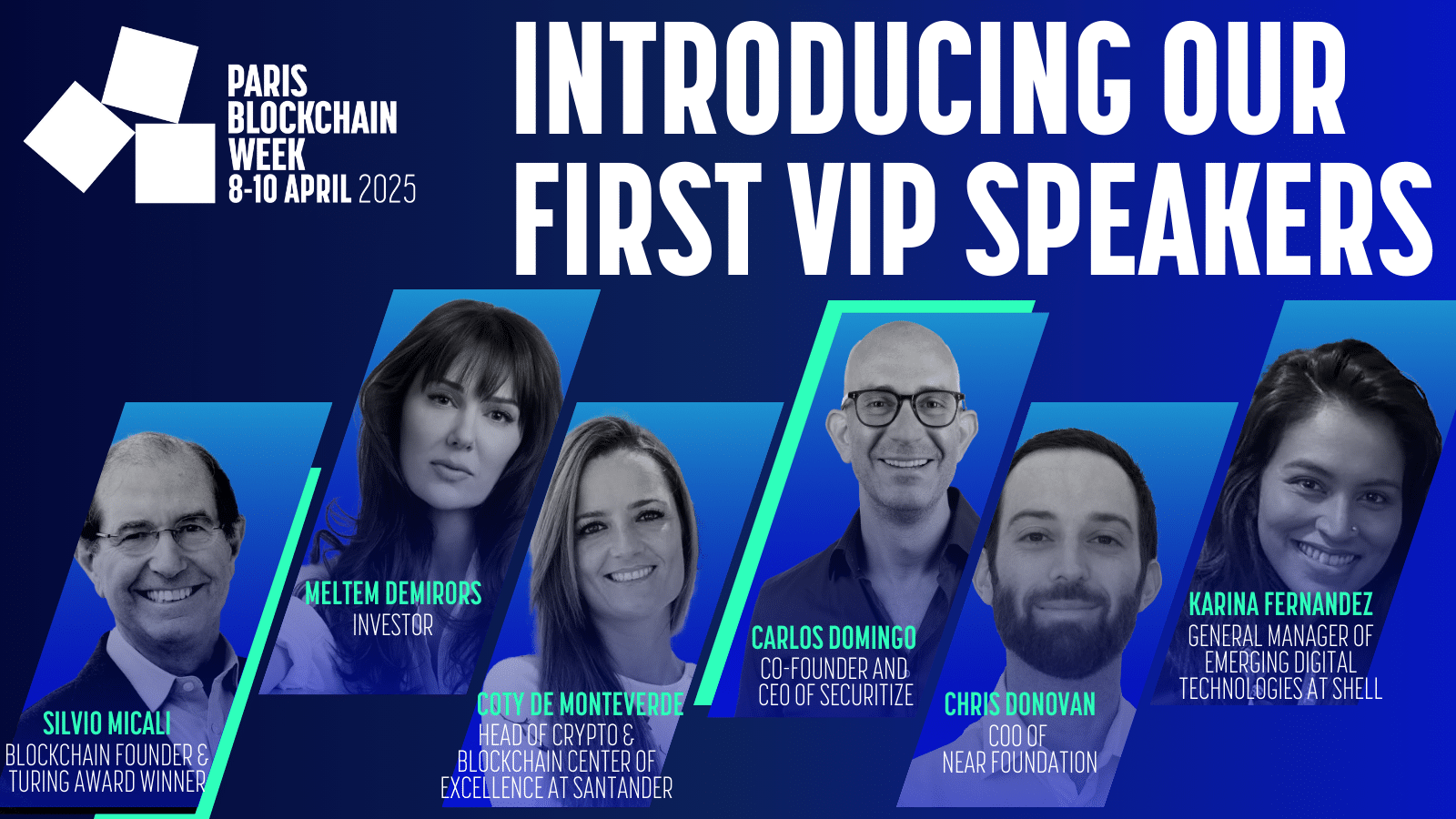

Paris Blockchain Week, the premier global event for blockchain professionals, reveals the first six headline speakers for its sixth edition, which will take place from April 8-10th, 2025, at the Carrousel du Louvre.

Ethereum ETFs pave the way for broader institutional adoption, but remain incomplete. According to Robbie Mitchnick of BlackRock, their main drawback lies in the absence of staking, a pillar of yield on Ethereum. This lack could limit their competitiveness against direct investment strategies, calling into question their ability to meet the expectations of professional investors.

Ah, the SEC... that watchdog of the crypto markets that sometimes gives us cold sweats. But this time, it has decided to put away its whistle and offer us a little breath of fresh air. On March 20, 2025, in an (almost) historic statement, the Securities and Exchange Commission clarified a point that many miners were waiting for like the thaw of spring: NO, mining in Proof-of-Work (PoW) does not constitute an offer of securities!

The end of the endless legal battle between the SEC and Ripple surprised no one, as investors had already anticipated this withdrawal due to a pro-crypto shift driven by the Trump administration. While the announcement marked the closure of one of the sector's most emblematic legal cases, the markets had already priced in this outcome well before it was officially announced.

The alignment of the planets continues. While the United States wants to accumulate "as many bitcoins as possible," the global money supply is climbing again.

2025 could mark a point of no return for crypto. As traditional markets navigate between uncertainties and capricious interest rates, financial institutions seem to have found their new compass: digital assets. According to a recent study by Coinbase and EY-Parthenon, 83% of institutional investors plan to increase their allocations to crypto starting next year. A shocking figure that conceals a more complex reality, but above all, a profound transformation of investment strategies. Far from clichés about volatility, crypto is becoming a pillar of institutional portfolios.

For a time, Tornado Cash was the ugly duckling of the blockchain. Accused of obscuring the trail of several billion dollars in dubious funds, the famous crypto mixer found itself on the U.S. Treasury's blacklist. But surprise on March 21: the axe fell... the other way around. The U.S. government simply lifted the sanctions against this protocol. A plot twist? Maybe. A signal of change? Definitely.

Ethereum continues to assert its supremacy in the world of stablecoins, with a record transaction volume of 850 billion dollars, largely dominated by USDT and USDC. This explosive growth raises questions: can this massive adoption actually impact the valuation of ETH or, on the contrary, benefit its competitors?